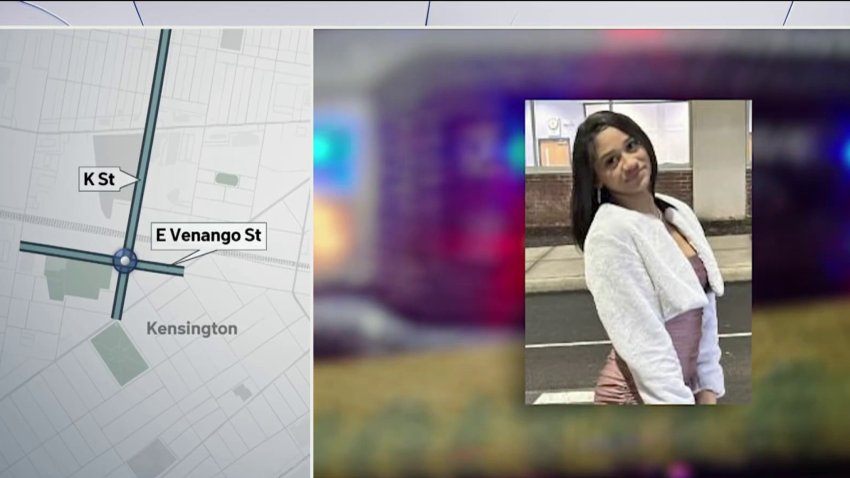

14-year-old girl believed to be kidnapped while on FaceTime with her mom, police say

Philadelphia police are searching for a teenage girl who police say may have been kidnapped in North Philadelphia Thursday afternoon.

-

Freeze Warning, Frost Advisory in effect for Philly area overnight into Friday

Freeze Warning, Frost Advisory in effect for Philly area overnight into Friday morning.

-

Truck strikes fire hydrant, causing geyser in Plymouth Meeting

A geyser of water spewed far into the air Thursday in Plymouth Meeting, Pennsylvania, after a tractor-trailer struck a fire hydrant.

-

Cars speed through waterlogged streets at the Jersey Shore creating more flood damage

Officials at the Jersey Shore say they have never seen the amount of flooding that they have seen since January. While the streets are flooded some “joyriders” are speeding their way down ... -

No new details released in the disappearance of Dulce Alvarez as her mother celebrates her 10th birthday

Dulce Maria Alvarez went missing from a South Jersey playground in 2019. Since then, Dulce has never been found. Her case drew local, state and federal law enforcement agencies to a park in Bridgeton,...