Sen. Casey, challenger McCormick ready to debate in Pa.'s 2024 US Senate race

-

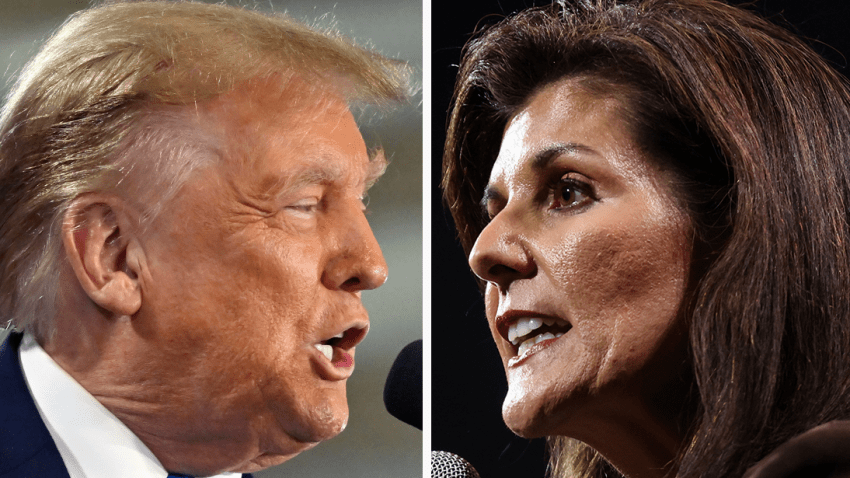

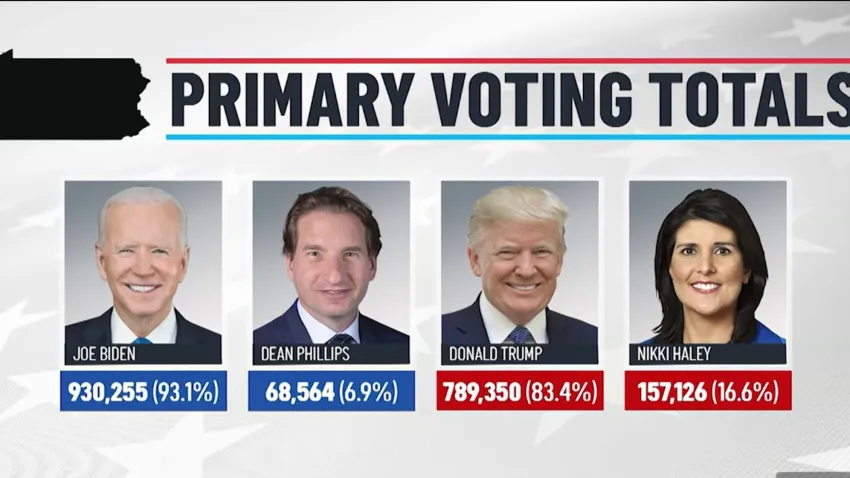

Biden 2024 campaign makes new digital ad push to court Nikki Haley voters

President Joe Biden’s reelection campaign is making a play to win over Pennsylvania Republican voters who chose former candidate Nikki Haley over their party’s presumptive nominee in Pennsylvania’s pr... -

Pa. redesigned mail-in ballot envelopes amid litigation. Some voters still tripped up

A form Pennsylvania voters must complete on the outside of the envelopes used to return mail-in ballots has been redesigned, but that didn’t prevent some voters from failing to complete it accur... -

Ex-National Enquirer publisher testifies he scooped up possibly damaging tales to shield Trump

As Donald Trump was running for president in 2016, his old friend at the National Enquirer was scooping up potentially damaging stories about the candidate and paying out tens of thousands of dollars ... -

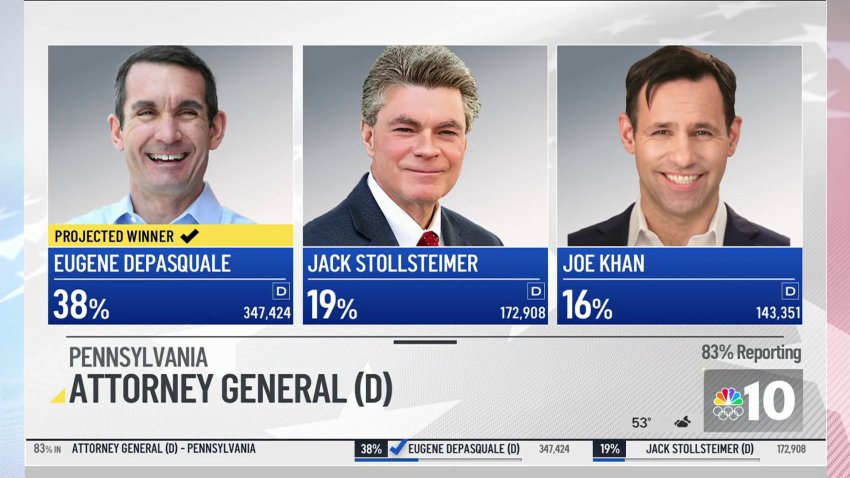

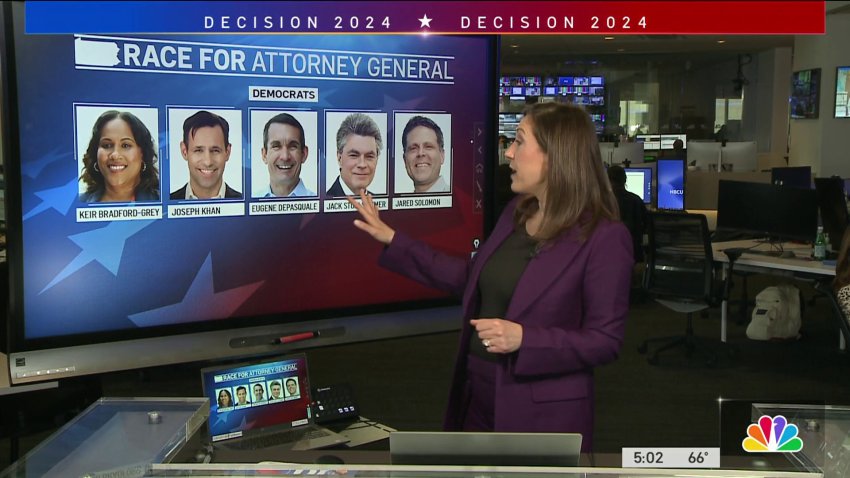

Clearer picture of the matchups ahead of November's election

The Pennsylvania primary is giving us more insight into the Presidential election in the key battleground state. Both President Biden and former President Trump are dealing with protest votes. NBC10 p...