Some people are investing in their retirement without even realizing it.

If you have a traditional job, you pay 6.2% of your salary per year in Social Security taxes. That number is then matched by your employer.

But there's a cap on how much money people are expected to contribute every year.

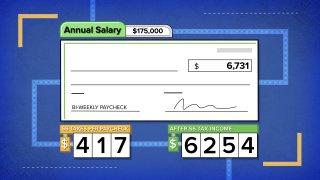

In 2021, you will pay Social Security taxes on all of your income up to $142,800. That is a $5,100 increase from the 2020 wage-based cap.

Get Philly local news, weather forecasts, sports and entertainment stories to your inbox. Sign up for NBC Philadelphia newsletters.

Check out this video for a full breakdown of what that means for your paycheck.

More from Invest in You:

How Walmart and other big companies are trying to recruit more teenage employees

Americans are more in debt than ever and experts say 'money disorders' may be to blame

How much money do you need to retire? Start with $1.7 million

Money Report

Disclosure: NBCUniversal and Comcast Ventures are investors in Acorns.