U.S. stocks rose again on Friday as the market's rally to records carried on amid strong earnings from blue-chip companies as well as solid data signaling a snapback in the economy.

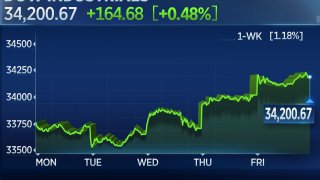

The Dow Jones Industrial Average gained 164.68 points, or 0.5%, to 34,200.67. The 30-stock benchmark crossed the 34,000 threshold for the first time ever in the previous session. The S&P 500 rose 0.4% to a new closing high of 4,185.47. The Nasdaq Composite inched up 0.1% to 14,052.34.

Wall Street wrapped up another winning week with the three major benchmarks all gaining more than 1%. The S&P 500 and the Dow posted their fourth straight positive week, while the tech-heavy Nasdaq has registered gains for three weeks in a row.

Get Philly local news, weather forecasts, sports and entertainment stories to your inbox. Sign up for NBC Philadelphia newsletters.

The last of the six largest U.S. banks to report– Morgan Stanley — posted stronger-than-expected earnings, bolstered by strong trading and investment banking results. Shares of the bank dipped 2.8%, trimming its year-to-date gains to about 14%.

PNC Financial gained more than 2% after the bank beat estimates on the top and bottom lines for its first-quarter report.

"The Dow's push through 34,000 is a signal that investor appetite for future growth prospects is spilling over into more value-oriented names," said Peter Essele, head of portfolio management at Commonwealth Financial Network. "The demand for industrials and more cyclically-oriented areas should continue as the vaccines take hold and earnings potentially come in higher than originally expected."

Money Report

Investor sentiment was boosted by a slew of economic data this week that pointed to a rebound in consumer spending, sentiment and the jobs market.

The University of Michigan said Friday its preliminary consumer sentiment index rose to a one-year high of 86.5 in the first half of this month from 84.9 in March.

Federal Reserve Governor Christopher Waller said Friday the U.S. economy is set to take off, but there's still no reason to start tightening policy.

"I think the economy is ready to rip," Waller told CNBC's Steve Liesman during a "Squawk on the Street" interview. "There's still more to do on that, but I think everyone's getting a lot more comfortable with having the virus under control and we're starting to see it in the form of economic activity."

Data out Thursday showed that Retail sales jumped 9.8% in March as additional stimulus sent consumer spending soaring, topping the Dow Jones estimate of a 6.1% gain. Meanwhile, the Labor Department reported 576,000 first-time filings for unemployment insurance for the week ended April 10, reaching the lowest level since March 2020.

S&P 500's strong performance in recent weeks has pushed its year-to-date gains to more than 11%. Cyclical sectors have been the biggest winners this year with energy and financials leading the rally.

"Rising animal spirits, in addition to historic fiscal stimulus and an improving public health picture, underpin our expectation for further improvement in economic activity over the coming months," Azhar Iqbal, Wells Fargo's econometrician, said in a note.

Enjoyed this article?

For exclusive stock picks, investment ideas and CNBC global livestream

Sign up for CNBC Pro

Start your free trial now