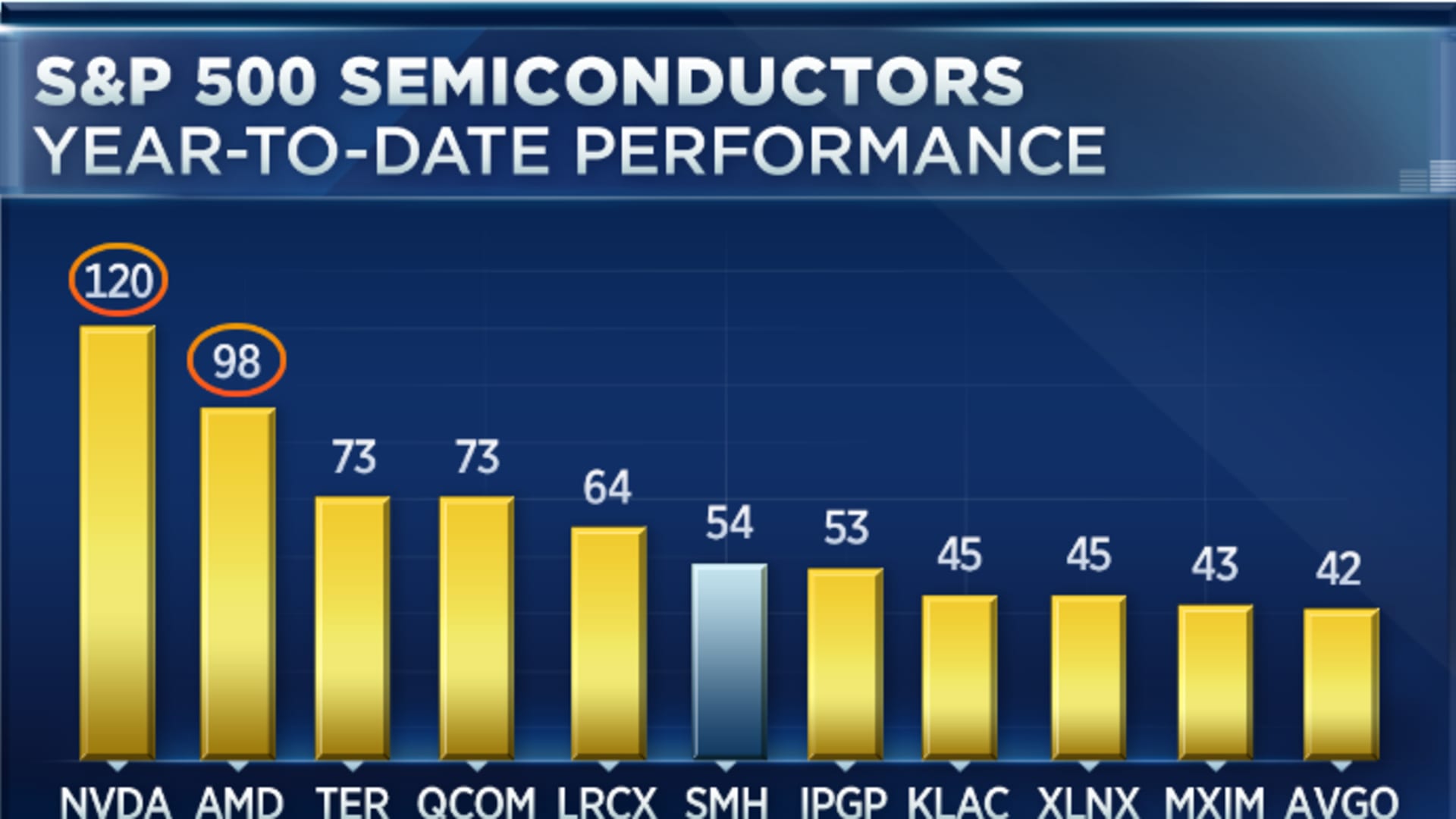

Two of this year's best-performing semiconductor stocks have hit a wall.

Chipmakers Nvidia and AMD have diverged from their competitors this month, falling nearly 2% and 0.5%, respectively, while the VanEck Vectors Semiconductor ETF (SMH) has climbed nearly 4.5%.

The lag could make for a near-term buying opportunity, JC O'Hara, chief market technician at MKM Partners, told CNBC's "Trading Nation" on Wednesday.

Get Philly local news, weather forecasts, sports and entertainment stories to your inbox. Sign up for NBC Philadelphia newsletters.

"This is a market where you want to own leadership. That's the only way for you to outperform a benchmark," he said. "When we look at the 19 semiconductor names within the S&P, we find leadership in Nvidia and AMD."

As of Wednesday's close, Nvidia was sitting on a year-to-date gain of nearly 123.5% and AMD was up over 101%.

"In the short term, they might become victims of their own success," O'Hara said. "If you're an institution and you own these names and these names doubled in size, come the end of the year, you need to rebalance. You need to resize. But this gives us an opportunity to buy a pullback within leadership."

Money Report

He said the short-term selling pressure will last for "a few more days [or] a few more weeks."

"I'm looking at being able to buy leadership at a discounted price. So, yes, I'm looking to buy the pullback in Nvidia and AMD," O'Hara said.

The chipmakers' fundamental outlook also looks "incredible," Chantico Global CEO Gina Sanchez said in the same "Trading Nation" interview.

"I wouldn't read too much into this pullback. I think it's a pullback," said Sanchez, who is also chief market strategist for Lido Advisors. "Quite frankly, what's driving the SMH really is Taiwan Semiconductor. And Taiwan Semiconductor has just been taking the cake from Intel. I think the best comment I heard was that Intel has been suffering tragically comic missteps. It has definitely been giving away a lot of revenue to the rest of the industry, and Taiwan Semiconductor has been there to benefit from that as the other single-largest foundry in the world."

Intel shares, which are down almost 19% year to date, have been on an upswing in recent days, driven by pressure from activist firm Third Point to explore "strategic alternatives."

As for Nvidia, AMD and the rest of the industry, Sanchez said various drivers — including cryptocurrency mining, online gaming, data center storage — were still in place and strong.

"The fundamentals are great, but I think a lot of this is already priced in," she said. "The entire semiconductor space has had a multiple expansion that has been extraordinary."

Disclosure: Lido Advisors owns shares of Nvidia and AMD. Sanchez owns shares of Intel.