At first, Kelly Ifill had no interest in following in her family's footsteps.

Her father has a long-running contracting business. Her grandmother ran a cleaning service. Her aunt, uncle and even some cousins have experienced the highs and lows of running a small business.

"I had no interest in being an entrepreneur," Ifill, 37, tells CNBC Make It with a chuckle. "I was like, 'I don't want that. It looks hard!'" Instead, she was a schoolteacher, then an MBA candidate and a staffer for seed-stage venture capital firms.

But things change. Ifill — who is Black — watched businesses in her Brooklyn, New York community struggle to stay afloat, their frustrations with traditional banks front and center. Black business owners are much less likely to be approved for commercial checking accounts and bank loans, often paying higher rates when they do land a loan.

Get Philly local news, weather forecasts, sports and entertainment stories to your inbox. Sign up for NBC Philadelphia newsletters.

In 2021, Ifill concluded that starting her own company was the best way to help other Black and minority entrepreneurs get their own businesses off the ground. In January, she launched Guava, an online banking platform aimed specifically at Black small-business owners.

The result: more than 3,000 members in seven months, reflecting "a diverse range of businesses, from candle companies to spin studios," the company says.

For context, Mercury — another online banking platform for startups — topped 100,000 customers in three years, according to TechCrunch. Many large banks boast millions of small-business customers each.

Money Report

Ifill credits Guava's early traction to her close understanding of entrepreneurship's most intense challenges.

"I have grown up understanding what that experience is," she says. "Especially for Black people [and] especially for immigrants in this country."

A lack of funding and banking options hurts Black entrepreneurs

Perhaps the biggest obstacle facing Black-owned businesses is an overall lack of access to capital.

Funding and support for Black-owned startups jumped in 2020, following a nationwide racial reckoning stemming from George Floyd's murder. In 2022, venture funding for those companies plummeted 45%, according to Crunchbase data.

"I wasn't particularly surprised," Ifill says, adding: "Without that kind of social pressure in 2022, we saw this contraction happen almost immediately, which I think has been a pattern that we can probably track back to multiple [past] bear markets."

When investments in Black-owned startups rose to historic levels in recent years, they still represented less than 2% of overall funding, Crunchbase's tracking shows. Less than 1% went to companies led by Black women.

Even with funding, many Black- and minority-owned businesses could struggle to store the cash, says Ifill. Data shows that Black communities are historically underbanked. Those borrowers are more likely to face challenges in accessing commercial banking accounts, which can be already be difficult to secure.

Such entrepreneurs are also less likely to receive the sort of support and mentoring that typically accompany venture capital backing and banking resources, Ifill notes: "They're left with Google, and maybe their uncle, to guide them, hopefully, in the right direction."

Those obstacles keep the U.S. small business economy from realizing "its full potential," she says. "Every entrepreneur has not had equitable access to the resources that would allow for them to build sustainable businesses, scalable businesses. That's a problem for everybody."

How access to resources, mentors and experts can make a difference

In a legal and regulatory sense, Guava isn't a traditional bank. It's an online banking platform — which is to say, it's a fintech startup that offers banking services fulfilled by New York's Piermont Bank, a fully-accredited Federal Deposit Insurance Corporation member.

In response, Guava lets small-business owners open checking accounts for their businesses "for free in minutes," as the company's website says. All accounts are tied to government IDs to mitigate fraud attempts, and deposited funds up to $250,000 are insured by the FDIC.

As for business loans, Guava is developing pilot programs with capital providers, from smaller community lenders to government Community Development Financial Institutions funds, Ifill says.

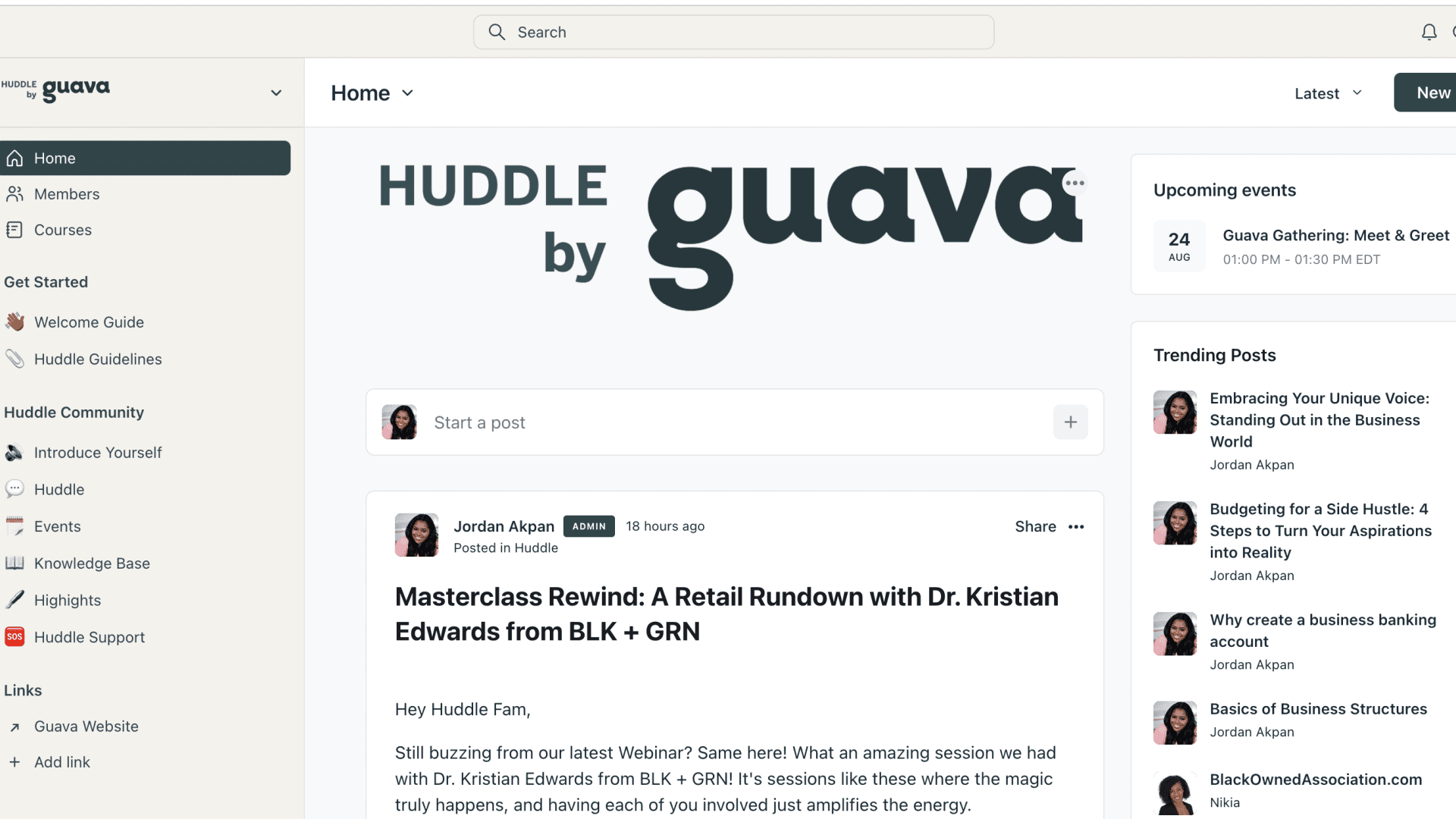

Her company also launched a networking hub called Huddle earlier this month, where members can share knowledge with each other, and learn from industry and financial experts.

"Your network [is] the most valuable resource that you have as an entrepreneur, [and] a lack of that for Black entrepreneurs is really major, and something that we need to rectify," says Ifill.

Guava has raised $2.4 million in a pre-seed funding round led by venture capital firm Heron Rock — a drop in the bucket compared to the largest VCs and institutional banks' billions of dollars. Ifill says she's encouraged by the early results, but realistic about the impact her young startup can have at this point.

"In no way do I think that Guava will close the racial wealth gap," she says. "This is something that requires support from businesses large and small, and policymakers."

That's especially due to the gap's sheer size: $14 trillion, describing the disparity in wealth between U.S. Black and white households, Duke University's William A. Darity, Jr. told CNBC last year.

But every little bit helps, Ifill maintains. The more people actively choose to support Black-owned small businesses, the more banks and financiers that investing in those businesses will produce strong returns, she says.

Minority-owned businesses produce 30% higher returns for investors, according to a recent report from management consulting firm McKinsey & Co. Greater parity in funding for those businesses could add more than $2 trillion to the broader economy, the report added.

"This is a profit driver," says Ifill. "It is clear for me, obviously."

This story has been updated to clarify the difference between banks and online banking platforms.

DON'T MISS: Want to be smarter and more successful with your money, work & life? Sign up for our new newsletter!

Get CNBC's free Warren Buffett Guide to Investing, which distills the billionaire's No. 1 best piece of advice for regular investors, do's and don'ts, and three key investing principles into a clear and simple guidebook.