This story is part of CNBC Make It's Millennial Money series, which details how people around the world earn, spend and save their money.

By the numbers, Sal Khan does really well for himself. The 31-year-old earns around $212,000 from his day job in tech sales. He started buying real estate in 2022 and now has four investment properties, which net him $8,000 a year with room to grow. He splurges on nice dinners out and makes time for vacations.

He also lives at home with his parents in Houston rent-free.

It's a financially savvy move, of course, but also means more.

Get Philly local news, weather forecasts, sports and entertainment stories to your inbox. Sign up for NBC Philadelphia newsletters.

Khan was born and raised in Pakistan as the youngest of five kids. His older siblings started moving to the U.S. when he was 9 years old, starting with his oldest brother, who came to the States for college.

Soon after, his oldest sister moved to Houston to work as a physician, and by the time Khan was 17, his parents moved to be close to her and help raise their grandchildren. They also started the process of gaining a green card. Khan stayed behind under the care of his grandfather as his other two siblings moved for work and school.

Khan was the last to move to the U.S. in 2013 at 20 years old when his parents sponsored his visa. He earned a finance and economics degree from Ohio State University and worked in the Bay Area for a few years until the pandemic prompted him to move in with his parents in Houston.

Money Report

What started as a temporary solution became a long-term arrangement that's strengthened their bond in meaningful ways.

"I do think my relationship now has been the best with my parents than it has been before," Khan tells CNBC Make It.

Here's how the arrangement impacts his personal life, his financial goals and his future plans.

Moving in with his parents

Khan was living in the Bay in 2020 when the pandemic hit. His lease ended in August, and while he could work remotely, he figured he'd move in with his parents in Houston to save money and wait out the pandemic. He planned to find his own apartment in the Houston area after a few months, but his parents proposed another idea.

Khan recalls his mother saying, "You can stay as long as you want."

As the youngest child in the family, and after spending roughly 10 years away from his parents, he saw it as a way to make up for lost time, or "an opportunity that we could use as a family and really improve our relationship." His oldest sister and her family also lived in the area, and his second sister and her family have since moved from Chicago to the Houston area.

Plus, Khan adds, "there is a cultural aspect to it where, as a son, it's required that you take care of your parents."

It was an adjustment living with his parents as his roommates and reasserting his independence as a single man in his 20s. But Khan says he and his parents have gotten better at communicating boundaries and expectations.

Khan doesn't pay any specific bills for the household, but covers other miscellaneous expenses, like the family's Costco membership, gas, some medical bills and, in one instance, his father's property taxes. Khan also gives his mom $200 a month as a gift to put toward whatever she chooses.

Khan's parents are retired and live off savings from selling their house in Pakistan, which also covered their house in Texas.

Khan's mother doesn't drive, so he'll make sure she gets around for her "great social life." He also accompanies his father on doctor's appointments.

He misses some parts of living in California, like his friends and being able to hit the beach. But those are easy "sacrifices," he says, to improve his financial future and spend more time with his family in Texas.

Dating while living at home

Moving home had a big impact on Khan's dating life. He had his fair share of dates who weren't on the same page about why he chooses to live with his parents.

"It's just one of those things where you just have to find people that understand your situation," Khan says.

As it turns out, Khan's girlfriend, Nina Nguyen, 29, also lives with her parents for both family and financial reasons.

"She understands it's a cultural thing and we can still be together with someone without actually needing to [share] an apartment or home," Khan says. That does mean, however, a lot of their shared time happens outside of their respective homes on dates, out at restaurants or on trips together.

"It's not easy to find someone who's comfortable with me living with my parents," he adds. "There is a social stigma to it. So the fact that she has never even once even asked me to move out, I think that's just being empathetic on her part."

Khan plans to move out of his current home when he has $2 million in assets, which he hopes will happen within the next five years. But that won't be the end of his living arrangement with this parents: Khan hopes to move his parents to his new home, too.

"They have explicitly mentioned that, wherever I go, they want to go with me," Khan says. He considers it the "biggest honor" to spend time with them and care for them as they get older.

Khan says it's also possible his girlfriend will want to continue living with her parents, so he's considering saving up for a house big enough for the couple and both sets of parents to live together.

How he spends his money

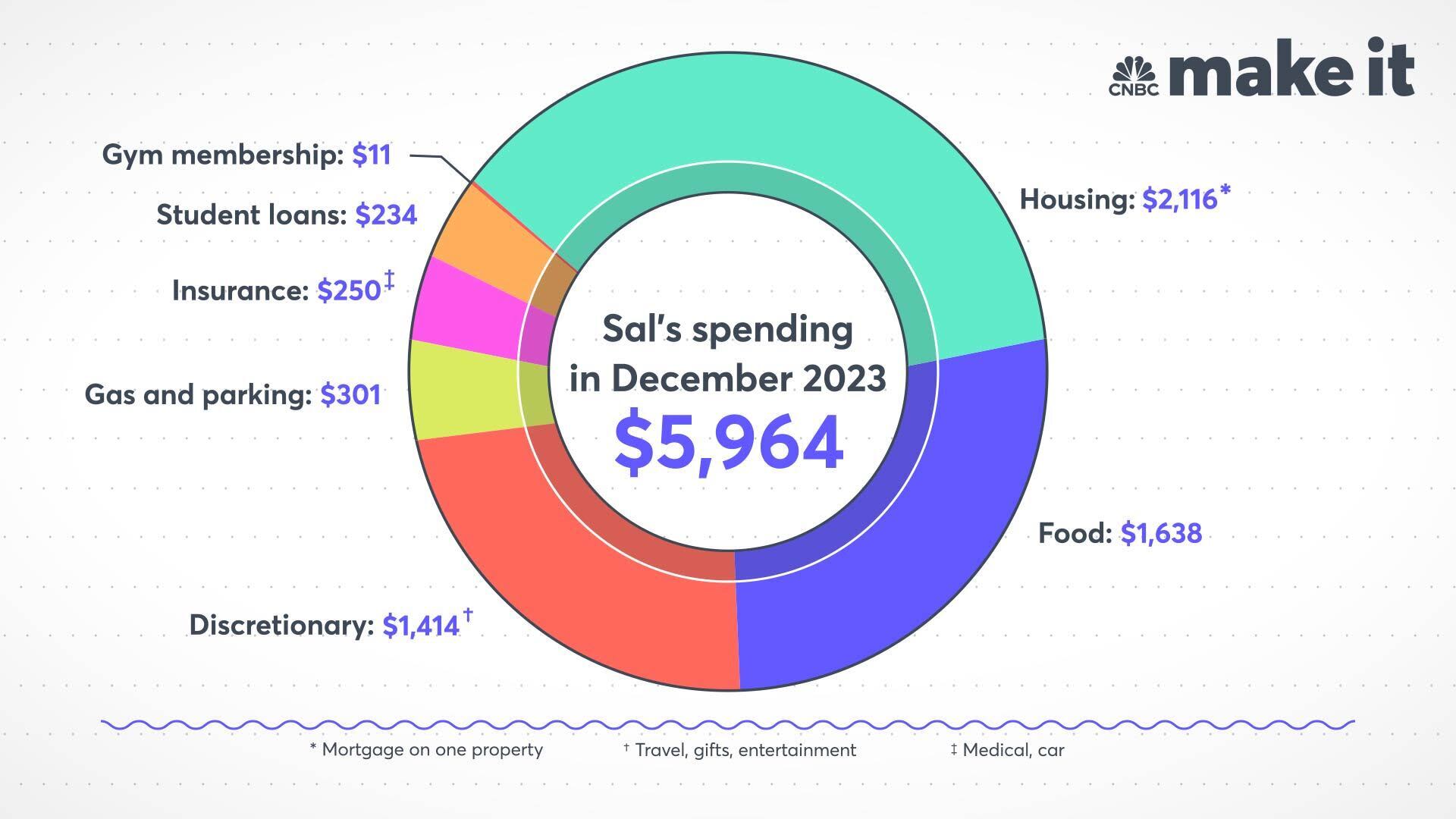

Here's how Khan spent his money in December 2023.

- Housing: $2,116 to cover the mortgage on one of his properties

- Food: $1,638 on groceries and meals out

- Discretionary: $1,414 on travel, gifts and entertainment

- Gas and parking: $301

- Insurance: $250, which includes $191 for car insurance and $59 for employer-provided health, dental, vision and life insurance

- Student loans: $234

- Gym membership: $11

Khan's only housing expense each month is to cover the mortgage on one of his properties in the Houston area, which he rents out to his older sister's family for $2,700 a month. It's his most lucrative investment property, netting him $584 each month.

Like a lot of people, Khan's December spending was higher than usual because of the holidays. He treated his family and girlfriend to a few nice dinners out and splurged on other entertainment, including a theater performance and cooking classes. He also took a trip to Arizona, which included a flight, car rental and trip to the Grand Canyon.

Khan graduated from college in 2016 with over $22,000 in student loans. He took advantage of the federal student loan payment pause during the pandemic and now has roughly $19,000 left. He makes the minimum payments of $234 each month.

For now, Khan says he'd rather focus on beefing up his investments rather than pay off his student debt, which has a low 4% interest rate.

Khan didn't make any savings or investments in the month of December. But in 2023, he stashed roughly 75% of his pay. He currently has around $212,000 in a Robinhood portfolio, $46,000 invested with Wealthfront and $37,000 in retirement savings.

Getting into real estate

Once Khan moved home and began saving the majority of his earnings, his older brother and brother-in-law encouraged him to consider investing in real estate.

He bought his first property, a single-family home in a nearby Texas town, in April 2022. Khan paid 20%, or roughly $95,000, for the down payment.

He couldn't find a good tenant to rent out the the 5-bedroom, 4-bedroom house. Thankfully, around the same time, one of his sisters was moving with her family from Chicago to the Houston area, and she ended up renting the home.

Since then, Khan has picked up three more properties: a multi-family parking garage and storage facility in Florida, a vacation rental in Arizona and another single-family home in California, where his brother currently lives.

Khan nets around $600 a month from all his properties, or nearly $8,000 a year, though he says it will be higher once he finds a new tenant for his California property after his brother moves out. By then, he expects to bring in up to $1,100 a month from his real estate portfolio.

The bulk of his savings are earmarked for more down payments on properties, Khan says. However, he wants to keep his portfolio manageable and will likely stick to 10 or fewer properties overall.

Looking ahead

Khan is laser focused on continuing to minimize his living expenses to pour his paychecks into real estate.

He hopes that, by sharing his story, he'll dispel the stigma of adults who live in the same household as their parents. For him, the arrangement has strengthened their relationship. Plus, the financial gains propelled him on the path to real estate investing and a more solid monetary future.

There's nothing to be ashamed about the decision, he says: "It's a choice that I made to be with my parents, and I'm grateful for this choice."

What's your budget breakdown? Share your story with us for a chance to be featured in a future installment.

Want to land your dream job in 2024? Take CNBC's new online course How to Ace Your Job Interview to learn what hiring managers are really looking for, body language techniques, what to say and not to say, and the best way to talk about pay. CNBC Make It readers can save 25% with discount code 25OFF.