He was named the youngest African American CEO of a publicly traded company at just age 23 -- Ephren Taylor was on the fast track and it seemed like nothing could stop him.

He was the toast of talk shows, the cables networks even appearing on the Today Show. He was intelligent, charismatic and a millionaire. He made the rounds at churches all across the nation, speaking to congregations about his book and financial security. The best part: Taylor even guaranteed some investments as risk-free and promised they could help the community.

But some they wished they never invested with Taylor or his companies. Now, some are involved in a class-action lawsuit filed against the once famed whiz kid. Some are even calling him the black Bernie Madoff.

Cathy Lerman, who filed the class action lawsuit against Taylor in the Eastern District of North Carolina, says this alleged Ponzi scheme targeted hundreds of hardworking churchgoers and stole millions of dollars from them. She says many of her clients claim they met Taylor when he delivered financial seminars at their churches.

According to the complaint, Taylor and his companies persuaded their victims to invest in what seemed like legitimate ventures such as sweepstakes machines and more, but never delivered what was promised. Taylor has not responded to the lawsuit.

The U.S. Secret Service, North Carolina’s Attorney General and the Secretary of State’s office in Georgia say they are investigating Taylor or his business.

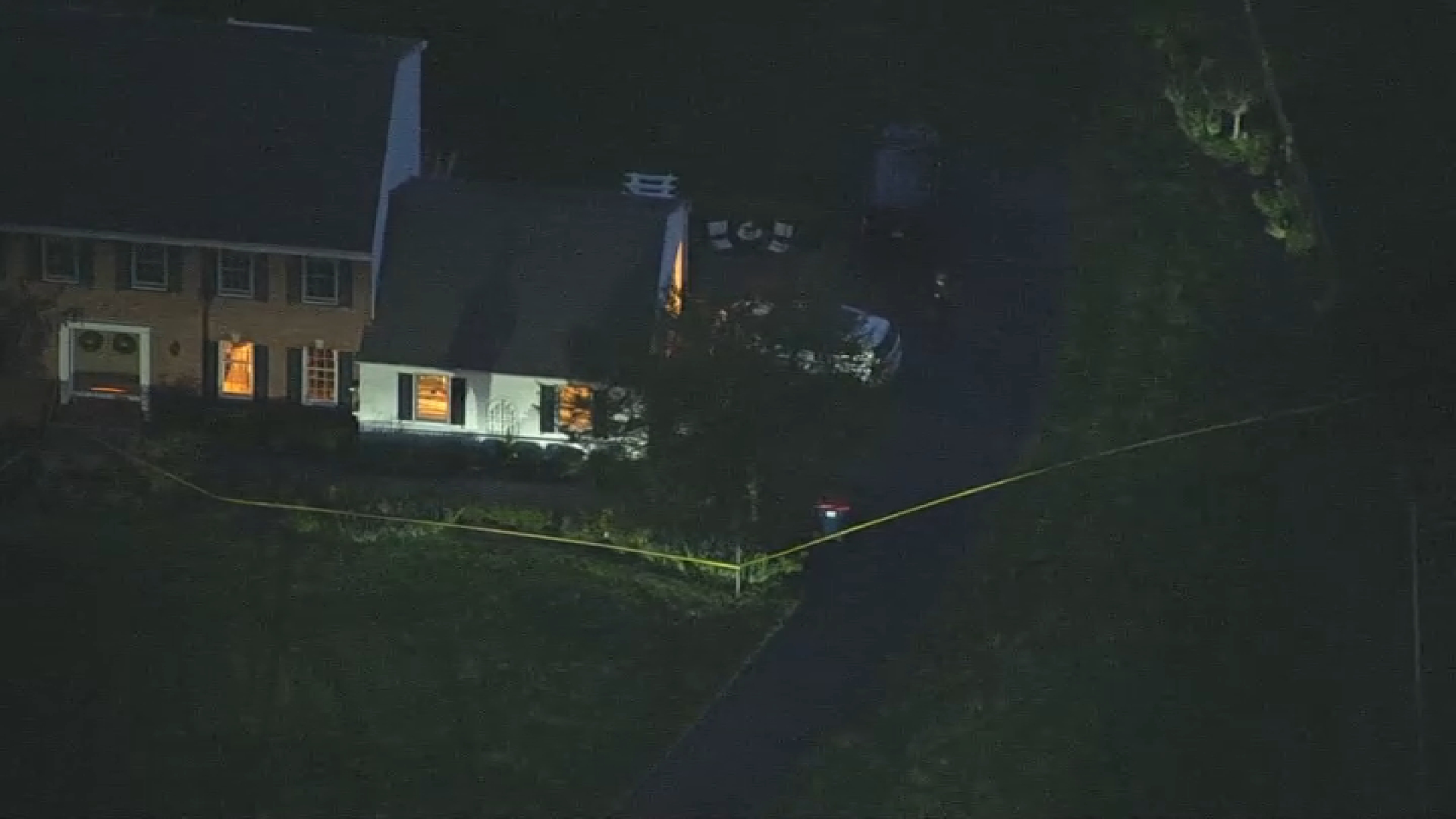

The NBC10 Investigators tried for weeks to talk to Taylor and hear his side of the story. Those efforts to find Taylor were unsuccessful, but he did release a statement to the Associated Press:

Local

Breaking news and the stories that matter to your neighborhood.

“In having this as the backdrop, recent media coverage, along with blogs that accuse me all types of things, has generated an image of someone that is not really who I am as a person. In addressing the negative coverage and the name calling, I can say it is easy to play the blame game and point fingers. However, that does not accomplish anything. Just like my other colleagues from Wall Street who are currently enduring the same thing, we are constantly being crucified but are not being provided with an opportunity to set the record straight.”

“...It is true that many people lost a lot of money, including myself, over the last few years in failed ventures, stocks, and market transactions, but this is part of investing. What I realize now more than ever is that sometimes people will participate in a game they don't have a stomach for, and when it goes south, they put the blame on those that led that game.”