NBC10 is one of dozens of news organizations producing BROKE in Philly, a collaborative reporting project on solutions to poverty and the city’s push toward economic justice. Follow us at @BrokeInPhilly.

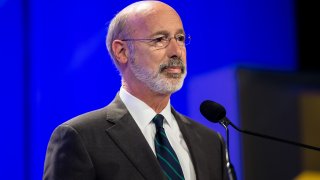

Gov. Tom Wolf asked lawmakers Wednesday to raise income taxes on higher earners and give public schools a massive boost in aid, as state government faces a gaping deficit and uncertainty over how much more pandemic relief the federal government will send.

For Wolf, a Democrat in his seventh year in office, his $4 billion income tax proposal and bid to use the money to supercharge public school funding is a return to the aggressive and ambitious budget proposals of his first two years in office.

The proposal to raise Pennsylvania's flat personal income tax rate and shift the burden to higher earners revives a concept he discussed in his first campaign for governor, in 2014, but never actually sought in office, until now.

Get Philly local news, weather forecasts, sports and entertainment stories to your inbox. Sign up for NBC Philadelphia newsletters.

Raising the income tax would allow Wolf to use $1.35 billion — a 20% boost — to help fix long-term inequities in how the state funds public schools, not to mention fill a projected multibillion-dollar deficit largely inflicted by the pandemic.

While it faces immediate opposition from Republicans in the GOP-controlled Legislature, the flat rate under Wolf's proposal would rise to 4.49% from 3.07%, or 46%, to raise what his office estimated to be $4 billion over a full-year, or about 25% more.

Exemptions would expand to cover the first $15,000 of income, up from $6,500 currently, meaning two-thirds of income-tax payers would pay less or the same amount, while the top one-third of earners would pay more, Wolf administration officials say. A family of four making about $84,000 or above would pay more, they say.

Republicans contend that the cost of the tax increase would be $7 billion annually, and say that such big expansions of the exemptions would run afoul of the state constitution’s uniform taxation clause.

The idea reflects the long-standing aims of Wolf and many education advocates to end what they see as a politically bent funding scheme that disadvantages school districts that are disproportionately poor or fast-growing.

More than half of the money would go to 10 urban districts — Philadelphia, Allentown, Reading, York, Scranton, Harrisburg, Wilkes-Barre, Upper Darby, Bethlehem and Erie — while fast-growing suburban districts would be among those getting the biggest percentage increase in state aid.

Now entering the lame-duck stretch of his second term, Wolf faces the same large Republican majorities in the House and Senate that have rejected nearly all his big ideas since he took office in 2015.

In a 20-minute speech that was recorded because of the pandemic, Wolf called on lawmakers to take a big step to improve public schools and help Pennsylvanians overcome barriers to opportunity, saying they destroy hope.

“They discourage the kind of broad ambition a free-market economy depends on,” Wolf said. "These fears, these barriers diminish all our lives, they destroy the optimism that drives a healthy society.”

All told, the budget proposal would increase spending through the state’s main bank account to $37.8 billion for the 2021-22 fiscal year starting July 1. Including a supplemental cash request to cover cost overruns in the current fiscal year, Wolf is seeking authorization for another roughly $5.5 billion in new spending, or almost 17% more.

Most of that increase would go to public schools and social services, including fast-growing Medicaid rolls and to reduce waiting lists for services for the intellectually disabled.

This year’s budget and next year’s budget rely heavily on federal pandemic aid. Counting that, spending on state operations would rise 10% to $40.2 billion.

With the pandemic affecting broad sectors, Wolf's budget would boost subsidies for the wages of child care workers, food banks and health departments.

It rejects appeals from nursing homes for an increase in Medicaid reimbursement rates and keeps funding flat for higher education institutions.

Republican lawmakers have not put out a plan to cover the deficit but suggest they will look to tap off-budget program reserves while avoiding cuts or tax increases. Meanwhile, state governments may see more federal budget aid from Congress.

Republicans and allies, including business and trade associations, said the income tax increase combined with a minimum wage increase Wolf is proposing would hurt small businesses and workers still recovering from the pandemic.

Senate President Pro Tempore Jake Corman, R-Centre, called Wolf's plan “completely unsustainable, totally irresponsible and absolutely crippling to the state’s economy.”

Democrats, labor unions, school advocacy groups and progressive organizations applauded the proposals.

Including off-budget proposals, Wolf is also asking lawmakers to impose a severance tax on the state's huge natural gas industry, ramp up borrowing and divert subsidies away from the horse racing industry.

In exchange, money would flow to public school construction, job training programs to boost an economic recovery from the pandemic and scholarships for students at state-system universities.

This is the seventh year that Wolf is proposing a tax on natural gas production in Pennsylvania after campaigning for office twice on making the industry pay its “fair share” in the nation's No. 2 gas state. Every year the Legislature has rejected the idea.

___

Follow Marc Levy on Twitter at www.twitter.com/timelywriter.