The S&P 500 rose Wednesday, closing at a record as the index heads for its best first quarter since 2019.

The broader market index gained 0.86% to close at 5,248.49, while the Dow Jones Industrial Average advanced 477.75 points, or 1.22%, to end at 39,760.08. Both indexes snapped three-day losing streaks. The Nasdaq Composite rose 0.51%, closing at 16,399.52.

Stocks rose in a broad rally Wednesday, with all 11 sectors of the S&P 500 registering gains. Utilities led the index higher, posting a nearly 2.8% jump. Real estate followed with a 2.4% advance, and industrials added 1.6%.

Get Philly local news, weather forecasts, sports and entertainment stories to your inbox. Sign up for NBC Philadelphia newsletters.

"Look at the S&P 500: Leadership's coming from the losers," said Art Hogan, chief market strategist with B. Riley Wealth. "So it really feels like a quarter-end rebalance and certainly more enthusiasm for equities, in what otherwise would be a quiet week, if not for the end of the quarter."

The major averages are poised to end the first quarter of 2024 on a strong note. The S&P 500 is tracking for a 10% advance, pacing for its best first-quarter gain since 2019 when it added 13.1%. The 30-stock Dow is up about 5.5%, and on pace for its best first-quarter gain since 2021, when it added 7.4%. The Nasdaq is up roughly 9.3% over the quarter.

March has also proven powerful, with the three major averages on pace for a fifth straight winning month. As of Wednesday's close, the S&P 500 is up about 3%. Both the Nasdaq and the Dow are up roughly 1.9% month to date.

Money Report

"A soft landing for the US economy is now widely expected, and markets have dialed back their expectations for interest rate cuts," wrote UBS Wealth Management strategists in a note.

"Looking ahead to the second quarter, we see the next stage of two primary market drivers playing out: the start of rate-cutting cycles by major central banks, and the broadening-out of AI adoption and implementation across a wider range of companies," they added.

Later this week, investors will watch for data on jobless claims, gross domestic product and consumer sentiment. While the market is closed on Good Friday, attention will be on economic releases tied to personal income, consumer spending and the personal consumption expenditures expected in the morning.

Stocks close higher

The S&P 500 and Dow Jones Industrial Average both closed higher Wednesday, snapping a three-session losing streak.

The broader market index rose 0.86% to settle at 5,248.49. The 30-stock Dow gained 1.22%, or 477.75 points, and finished at 39,760.08. The tech-heavy Nasdaq Composite was the trailing index, coming in with a rise of 0.51% to close at 16,399.52.

— Lisa Kailai Han

Small caps outperform

Small-cap stocks saw outsized gains on Wednesday, offering a bright spot amid a period of underperformance.

The small cap-focused Russell 2000 climbed more than 1.5% during afternoon trading. By comparison, the broad S&P 500 added just 0.5%.

That advance comes during a relatively tough year for smaller names in the market. The Russell 2000 has risen less than 4% so far in 2024, while the S&P 500 has jumped almost 10% during the same time frame.

— Alex Harring

Apple underperforming S&P 500 by widest margin since October 2013, according to Bespoke

Waning China sales and a lack of a clear artificial intelligence story have dragged shares of Apple down so far this year.

The "Magnificent Seven" darling, which soared an eye-watering 48% last year, has retreated 12% in 2024. The 200-day performance spread of Apple versus the S&P 500 has not looked this wide since October 2013, according to a tweet from Bespoke Investment Group.

Bespoke noted that the market can rally without Apple, but it is rare. The S&P 500's median change was a loss of 9.3% during periods when Apple declined over a 200-day trading window.

— Lisa Kailai Han

Oil prices slip on U.S. crude stockpile increase

Crude oil futures fell for a second day Wednesday as U.S. crude stockpiles rose.

The West Texas Intermediate contract for May delivery fell 27 cents, or 0.33%, to settle at $81.35 a barrel Wednesday. The Brent contract for May delivery dropped 16 cents, or 0.19%, to $86.09 a barrel.

U.S. commercial crude stockpiles, which exclude the strategic petroleum reserve, rose by 3.2 million barrels for the week ending March 22, according to the Energy Information Administration. Gasoline inventories rose by 1.3 million barrels.

— Spencer Kimball

April is Amazon's best month

Amazon is about to head into what has historically been its best month of the year, according to BTIG.

Since 2000, Amazon has averaged a 9.87% gain in April, Jonathan Krinsky, the firm's chief market technician, said in a note Tuesday. It has gone up 18 times in April since that time and down just five times, he said.

"The chart has been consolidating in the area of its 2020-2021 highs (180-190)," Krinsky pointed out. "Clearing that range should open the door well north of 200, in our view."

Shares of Amazon closed at 178.30 on Tuesday and are up about 17% year to date.

— Michelle Fox

Altimeter Capital's Gerstner buys Alphabet and Tesla

Altimeter Capital's Brad Gerstner is betting on some of the first quarter's biggest technology underperformers.

The tech investor revealed fresh positions in Alphabet and Tesla during an interview with CNBC's "Halftime Report" on Wednesday.

Read more on why he is scooping up these stocks here.

— Samantha Subin

Equal-weighted ETF outperforms in broad rally

The rest of the market is picking up the slack for Big Tech on Wednesday.

The Invesco S&P 500 Equal Weight ETF (RSP) was up 0.9% in afternoon trading. That was nearly triple the gain of the S&P 500, while the tech-heavy Nasdaq-100 was flat.

If the RSP can continue to rise and outperform the major benchmarks in the coming days, it could be a sign that the rally is broadening out and closing the gap between the "Magnificent Seven" stocks and the rest of the market.

— Jesse Pound

Morgan Stanley's top automotive analyst slashes Tesla delivery forecast 9%

Morgan Stanley's head of global auto and shared mobility research cut his forecast for Tesla vehicle deliveries on Wednesday, saying he expects the electric vehicle giant to raise prices to compensate.

Adam Jonas now expects first-quarter deliveries of 425,400, a 9% decrease from his previous forecast of 469,400. Jonas' new forecast implies 0.6% year-over-year delivery growth. He also lowered his full-year delivery estimate to 1.95 million, down from 1.99 million, or 8% year-over-year growth.

— Brian Evans

CNBC survey: Stocks are due for a pullback

A majority of investors in the CNBC Delivering Alpha stock survey believe the stock market is due for a pullback.

The newest survey shows that 61% of respondents are expecting a market pullback in the near term. The same percentage believes the Federal Reserve will only cut rates twice this year, which is below the three cuts projected by the central bank at its most recent meeting.

— Jesse Pound

Stocks making the biggest moves midday

These are some of the stocks on the move during midday trading.

- GameStop — GameStop shed nearly 15% after the video game retailer reported lower fourth-quarter revenue from a year ago.

- Merck — Merck jumped 4% after the U.S. Food and Drug Administration on Tuesday approved its drug to treat a life-threatening lung condition.

- Carnival — Shares slipped 2% after the cruise operator reported first-quarter revenue of $5.41 billion, below the $5.43 billion expected from analysts polled by LSEG, formerly known as Refinitiv.

Read the full list of stocks on the move here.

— Samantha Subin

S&P 500 and Dow on track for winning month and quarter, despite 3-day losing streak

The S&P 500 and Dow Jones Industrial Average were up early Tuesday afternoon after posting three losing sessions in a row.

Despite these recent declines, both indexes are on pace to close the current month and quarter higher. The broader market index has added 2.4% this month and 9.4% this quarter, while the 30-stock Dow is set for a 1.2% increase in March and a 4.7% rise this quarter.

The Nasdaq Composite has closed two back-to-back losses. The tech-heavy index has climbed 1.3% in March and 8.6% during the three-month period.

— Lisa Kailai Han

23 stocks in the S&P 500 hit new all-time highs

23 stocks in the S&P 500 index hit new 52-week highs during Wednesday's trading session.

These include Merck, which gained 4% after the U.S. Food and Drug Administration approved a new drug that could treat a fatal lung disease.

Here are some other names that hit this milestone today:

- Hilton Worldwide trading at all-time highs back to its initial public offering in December 2013

- Royal Caribbean trading at all-time-high levels back to its IPO in April 1993

- Colgate-Palmolive trading at all-time-high levels back to its first listing on the New York Stock Exchange in 1930 — the company was founded in 1806

- Ameriprise Financial trading at all-time highs back to its IPO in October 2005

- Boston Scientific trading at all-time-high levels back to its IPO in May 1992

- Cigna trading at all-time-high levels back to its IPO in 1972

- Cintas trading at all-time-high levels back to its IPO in 1983

- Vulcan Materials trading at all-time-high levels back through our history to 1972

— Lisa Kailai Han, Christopher Hayes

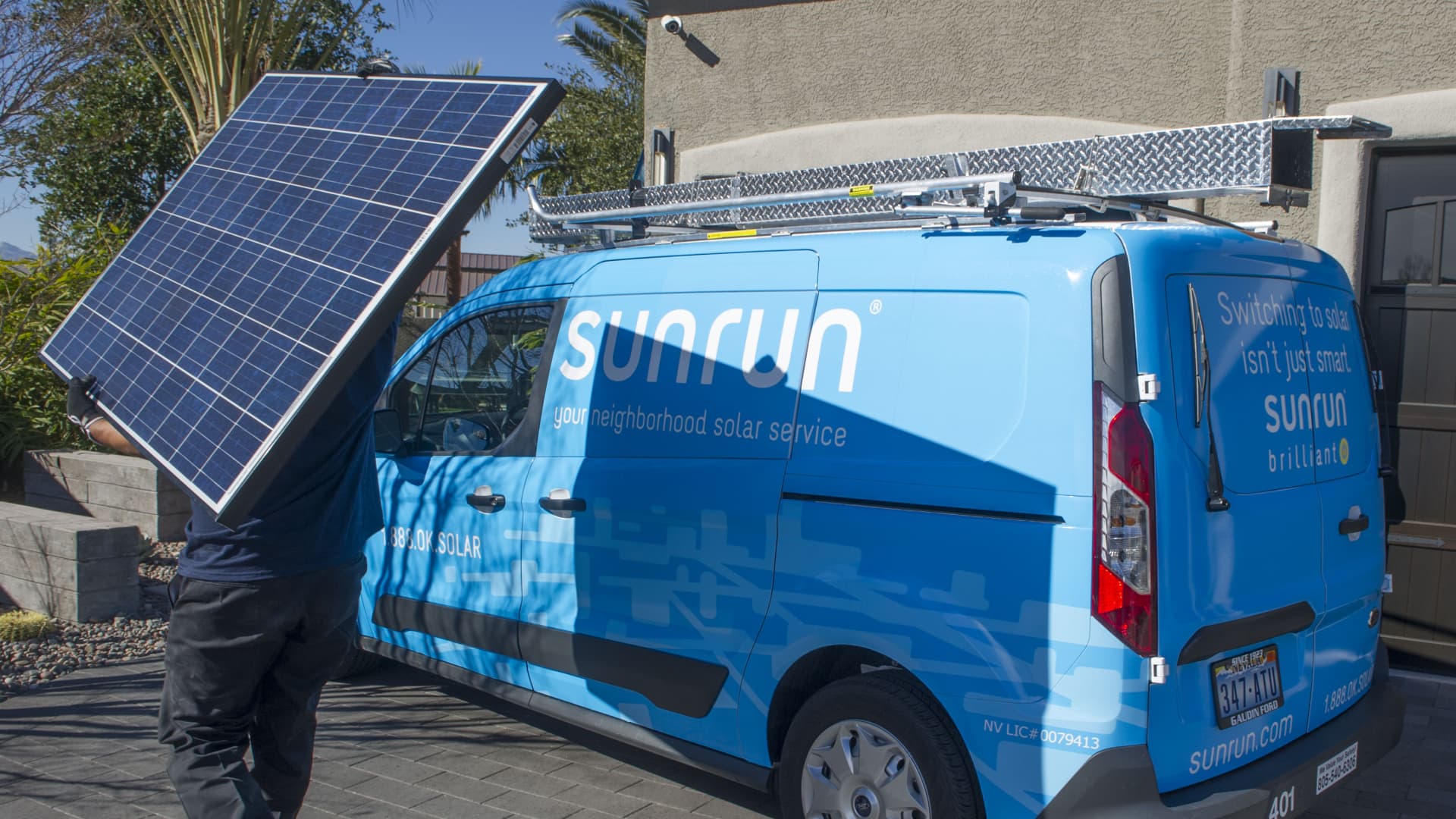

Solar stocks pop

Solar stocks rallied on Wednesday, making up some ground amid a rough year.

The Invesco Solar ETF (TAN) climbed more than 4%, on track for its best day in more than a month. Sunrun, Sunnova and Maxeon led the exchange-traded fund up, will all three gaining more than 10% in the session.

Wednesday's advance marks a reprieve from a tough period for the sector. The ETF is still down more than 16% in 2024, putting the fund on pace for its fourth straight losing year.

— Alex Harring

Cintas shares rally 10%

Cintas' stock surged 10% to a new 52-week high on Wednesday. The company reported a beat on both the top and bottom lines in the fiscal third quarter. Management also raised its full-year earnings and revenue guidance and topped analysts' estimates.

Cintas now forecasts earnings per share to fall in a range between $14.80 and $15, compared to consensus forecasts of $14.59, according to FactSet. Revenue guidance came in at $9.57 billion to $9.6 billion, versus $9.56 billion, per analysts polled by FactSet.

— Hakyung Kim

Coinbase shares fall after ruling in litigation with the SEC

Shares of Coinbase fell more than 2% Wednesday morning after a judge ruled the U.S. Securities and Exchange Commission has sufficiently pleaded that the crypto services company operates as an exchange under federal securities law.

In June 2023, the SEC sued Coinbase, alleging that it was operating as an unregistered exchange and broker, and that 13 of its assets were considered crypto asset securities. Two months later, the company moved to have that lawsuit dismissed, alleging that the SEC had acted outside its jurisdiction.

The shares are still up 49% this year and a whopping 315% over the past year despite its legal woes.

— Tanaya Macheel

GameStop shares plummet after revenue drop, job cuts

GameStop shares plunged more than 14% after the video game retailer reported a sharp drop in fourth-quarter revenue from the year-ago period. In its fourth quarter, the company posted revenue of $1.79 billion, lower than the $2.23 billion it reported in the same quarter the previous year.

Separately, the company said it has laid off employees by an unspecified number during the quarter to cut costs.

— Sarah Min

The S&P 500 opens higher following three straight losing sessions

The S&P 500 opened higher on Tuesday as it looked to snap a three-day losing streak.

The broader market index rose 0.6%, as did the tech-heavy Nasdaq Composite. The Dow Jones Industrial Average increased 216 points, or 0.6%.

— Lisa Kailai Han

Wedbush cools on Netflix

Investment firm Wedbush removed Netflix from its "Best Ideas List," saying the streaming video giant may need to find new growth areas to spur another big rally.

"We think it will be much harder for Netflix to impress investors in 2024 vs. 2023. Some of the growth drivers have been fully priced in, such as the password-sharing crackdown. We think there's still some benefit from that, but it's marginal and now expected," the firm said in a note to clients.

Netflix's ad tier, meanwhile, seems unlikely to be an earnings growth driver until 2025, according to Wedbush.

Even with the potential for lower growth, Wedbush still has an outperform rating on Netflix. Shares of the company are up 29% year to date.

— Jesse Pound

Stocks making the biggest moves premarket

Check out some of the companies making headlines in premarket trading.

- Robinhood — Shares of the brokerage firm jumped more than 6% after unveiling its Robinhood Gold Card, a credit card where cash back can be deposited into a brokerage account.

- Concentrix — Shares slipped nearly 4% on the back of disappointing fiscal second-quarter earnings guidance. The customer experience technology company also reiterated its full-year outlook for 2024.

- GameStop — Shares plummeted more than 17% after the video game retailer reported a large decline in revenue in the fourth quarter compared to the year-earlier period. The company added that it also reduced its workforce by an unspecified number throughout the quarter to cut costs.

Read the full list here.

— Brian Evans

U.S. elections shouldn't have huge effect on IRA clean hydrogen tax credits, Barclays says

The outcome of the upcoming U.S. elections is not likely to have a huge effect on stocks benefiting from the Inflation Reduction Act's clean hydrogen tax credits, according to Barclays.

"With the upcoming US election this year, we've received a number of investor inquiries around potential changes to the IRA under different US election scenarios. Under all three election scenarios — blue wave, red wave, divided government — we see limited risk from the hydrogen tax credits, with the 45Q (blue) credit likely more insulated from change relative to 45V (green)," the bank wrote in a Tuesday note.

In the event of a red wave, Republicans could certainly try to repeal pieces of the IRA. However, Barclays noted that hydrogen tax credits are more protected than other parts of the IRA.

— Lisa Kailai Han

Small- and mid-cap stocks could be a good hedge against over-concentration, UBS says

There is merit in the artificial intelligence trade, but UBS says investors should not forget about one stock category: small caps and midcaps.

"While we believe the excitement over AI is rational, we also see attractive value in small- and mid-sized companies. With rising risk of over-concentration, we believe adding small- and mid-cap companies to a portfolio has the potential to boost returns and improve diversification over the long term," the bank wrote in a Tuesday note.

Investing in smaller companies has the added benefit of gaining exposure to other structural growth themes, such as the energy transition, health-care disruption and water scarcity. Valuations are low and improving, while supportive macro inflections are also emerging for small- and mid-cap names, UBS added.

— Lisa Kailai Han

Merck rises on approval for drug against rare lung disease

Merck shares were up more than 4% during premarket trading after the U.S. Food and Drug Administration approved on Tuesday the use of Winrevair, a drug aimed at treating adults with pulmonary arterial hypertension.

"This is a really great opportunity for the company, but really, more importantly, a great important opportunity for patients," Merck chief medical officer Eliav Barr told CNBC.

— Fred Imbert

Bank of Japan will watch currency moves and effect on economy, Governor Ueda says

Bank of Japan will keep an eye on currency moves as well as their effect on the country's economy, Governor Kazuo Ueda reportedly said Wednesday.

"Currency moves are among factors that have a big impact on the economy and prices," Ueda told parliament, according to a Reuters report.

The Japanese yen hit its weakest level against the dollar in about 34 years at 151.97 earlier in the session. It was last trading at 151.72.

Japan's central bank ended its negative interest rate policy after eight years last week and abolished its yield curve control policy.

— Shreyashi Sanyal, Reuters

Yen hits weakest level since 1990, raising expectations of intervention

The Japanese yen hit its weakest level against the greenback on Wednesday in about 34 years, falling to as low as 151.97 before strengthening slightly.

The Yen fell below its previous record low of 151.95 reached in October 2022.

Japanese officials have been issuing strongly worded statements regarding the currency, with finance minister Shunichi Suzuki reportedly saying the country "won't rule out any steps to respond to disorderly FX moves."

— Lim Hui Jie

China combined industrial profits for January and February climb 10.2%

China's combined industrial profit for January and February climbed 10.2% year on year, according to data from the country's statistics bureau.

State-owned enterprises' profits grew 0.5% in January and February, while foreign firms, including those in Hong Kong, Macau and Taiwan, booked a 31.2% gain in profits.

NBS data also showed profits at private sector companies rose 12.7% year on year.

Industrial profit for 2023 fell 2.3%.

— Lim Hui Jie

Hybe shares soar over 7% as BTS' agency signs distribution deal with Universal Music Group

Shares of K-Pop agency Hybe Entertainment rose as much as 7.4% after the agency signed an exclusive distribution agreement with Universal Music Group for the next 10 years.

The move brought its share price to the highest level in about three months, with the stock on track for its largest one-day gain since October 2023.

Artists under UMG include Taylor Swift, Ariana Grande and Justin Bieber.

Hybe, which is home to K-Pop sensation BTS, said the agreement allows it access to UMG's network.

UMG will also collaborate with Hybe's fan platform, Weverse, "bringing more of a direct connection between UMG artists and their fandom," the announcement said.

— Lim Hui Jie

Stocks are likely to continue rallying on rising recession risks, Piper Sandler says

Rising risks of recession are unlikely to put a damper on the current market rally, according to Piper Sandler.

In fact, the opposite might be true.

"We believe stocks will rally on rising recession risks (i.e., softer macro data) — certainly an unusual take!" the investment firm wrote. "We remain constructive with the view that lower rates from softer macro data will set up stocks for another leg higher in the coming quarters."

Going forward, Piper Sandler views higher rates as the greatest threat to the market rally and the most likely catalyst for a correction.

— Lisa Kailai Han

Bitcoin's current market cap is greater than GDP of 159 of the world's economies, plus other surprising statistics from HSBC

In a Tuesday note, HSBC Global Research released a list of 13 surprising market statistics.

Here are a few:

- "The current market cap of Bitcoin is higher than the GDP of 159 of the world's economies in 2023."

- "40% of retail sales in Korea take place online vs less than 25% in the US and western Europe."

- "Annual cement consumption in China is down 15% since 2020, but it is still more than the US has consumed in the last 20 years."

- "India, Korea, and Taiwan all have twice the number of large, liquid companies open to foreign investors than there are in mainland China."

— Lisa Kailai Han

Stock futures are slightly higher

Stock futures traded up modestly shortly after 6 p.m. ET.

Dow futures added 0.2%. S&P 500 and Nasdaq 100 futures each ticked up 0.1%.

— Alex Harring