It's a tale of two chipmakers in the semiconductor space.

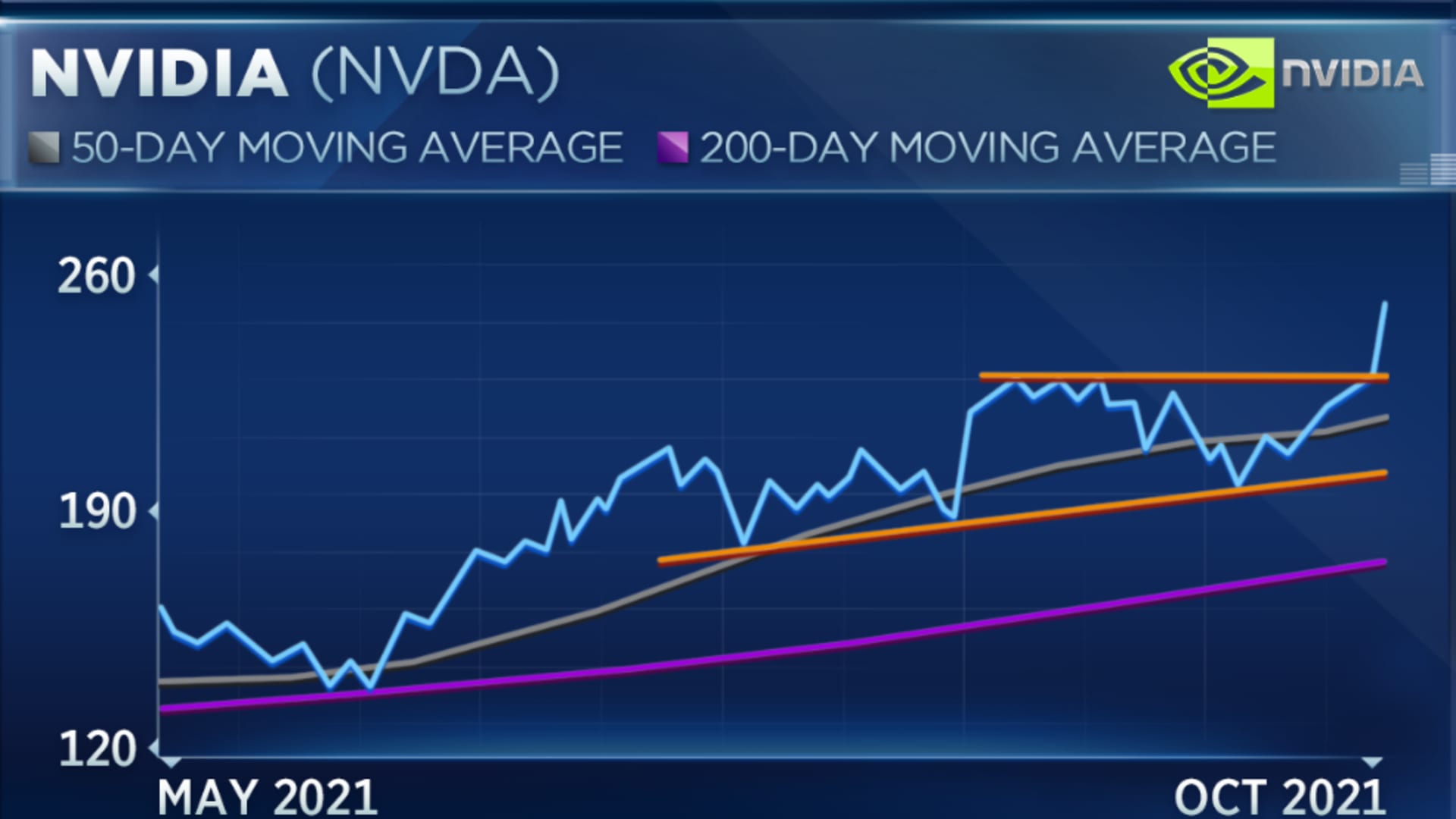

Nvidia, the largest stock in the SMH semiconductor ETF, hit records Tuesday and rallied another 7% on hopes Facebook's investment in virtual reality and the metaverse will be beneficial. The shares are up nearly 90% this year.

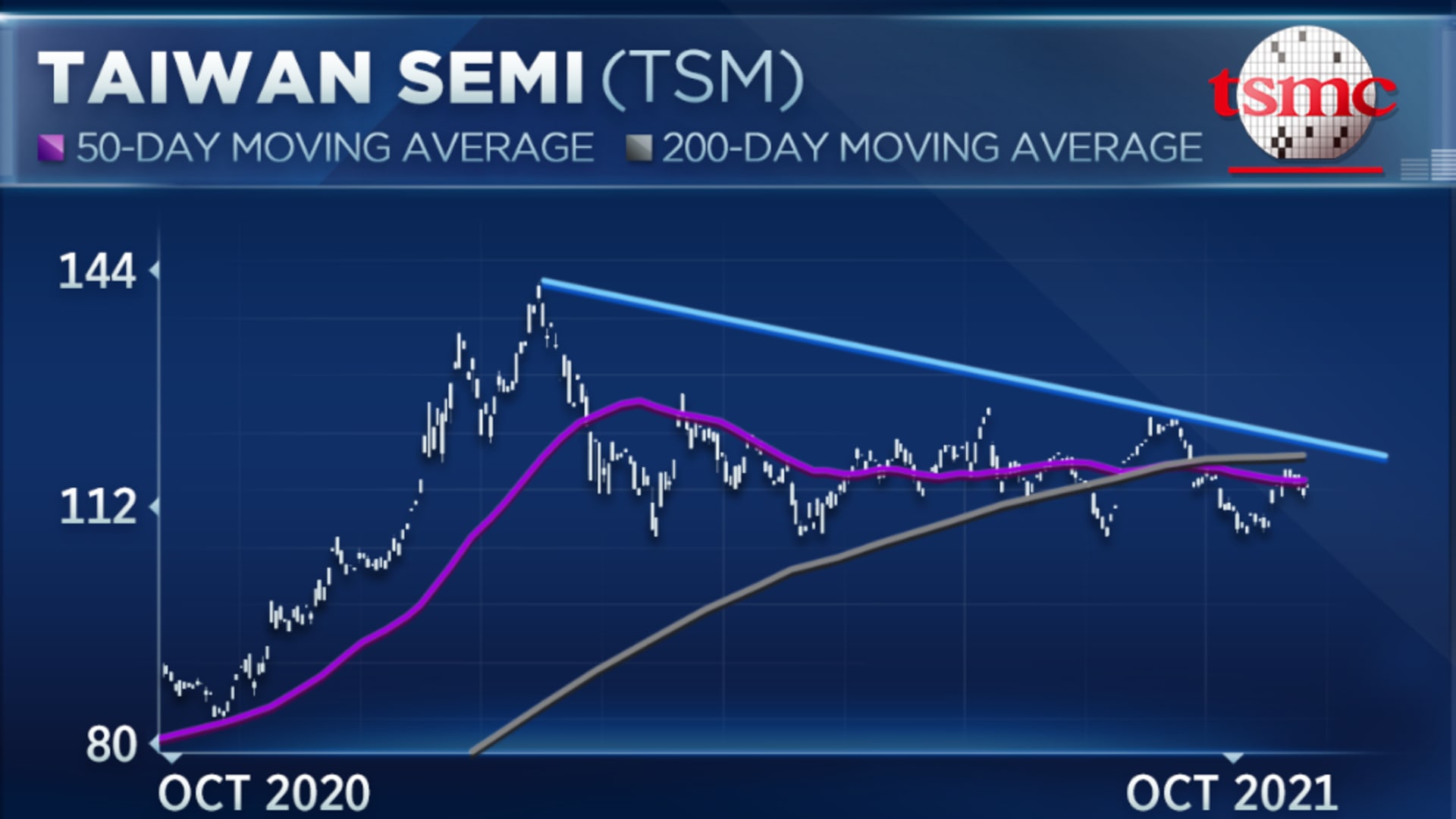

Taiwan Semiconductor Manufacturing Co., the second-largest SMH stock, has had a very different year. The shares are up just 5% and have fallen 20% from a February peak.

Get Philly local news, weather forecasts, sports and entertainment stories to your inbox. Sign up for NBC Philadelphia newsletters.

"Remember that Nvidia and Taiwan Semiconductor are two totally different business models," Gina Sanchez, chief market strategist at Lido Advisors, told CNBC's "Trading Nation" on Tuesday. "Taiwan Semiconductor is a pure play on the fab. Nvidia is a fabless play on innovation. … This investment by Facebook will benefit Nvidia because Nvidia is the fastest chip out there."

Fab, or fabrication, refers to the semiconductor manufacturing process. Companies like Nvidia are "fabless" in that they design the end product but outsource the actual manufacturing to a plant.

Passive investing should also continue to benefit Nvidia, according to Bill Baruch, president of Blue Line Capital.

Money Report

"Passive flows really drive these momentum names, and if you look at it from an ETF basis, there's about $70 billion of Nvidia within ETFs and only about $1.5 billion of Taiwan Semiconductor," Baruch said during the same interview.

The technical setup also looks stronger for Nvidia given it's breaking out, said Baruch, and investors should be on the lookout for any weakness as an opportunity. He highlights $220 to $230 as an area of support that could be bought – Nvidia closed Tuesday at $247.

"With Taiwan Semiconductor right now, you've had the death cross, which has probably incurred some additional selling, it's kept it suppressed even when the Nasdaq and broader tech names have moved higher in the recent weeks," Baruch added.

TSMC entered a death cross in August when its 50-day moving average moved below its 200-day, a bearish signal that suggests a change in trend. Baruch would need to see a move above $120 before he would reconsider the stock – it traded Tuesday at $114.

Sanchez added that potential Nvidia investors must be comfortable with a high valuation. The stock trades at 54 times forward earnings, more than double the multiple for the S&P 500.

"Nvidia is a highly priced stock and so you have to believe that the story is there for the long term if you're going to get it at these valuations. Lido Advisors has held Nvidia for years and so for us it's very easy to keep holding," she said.