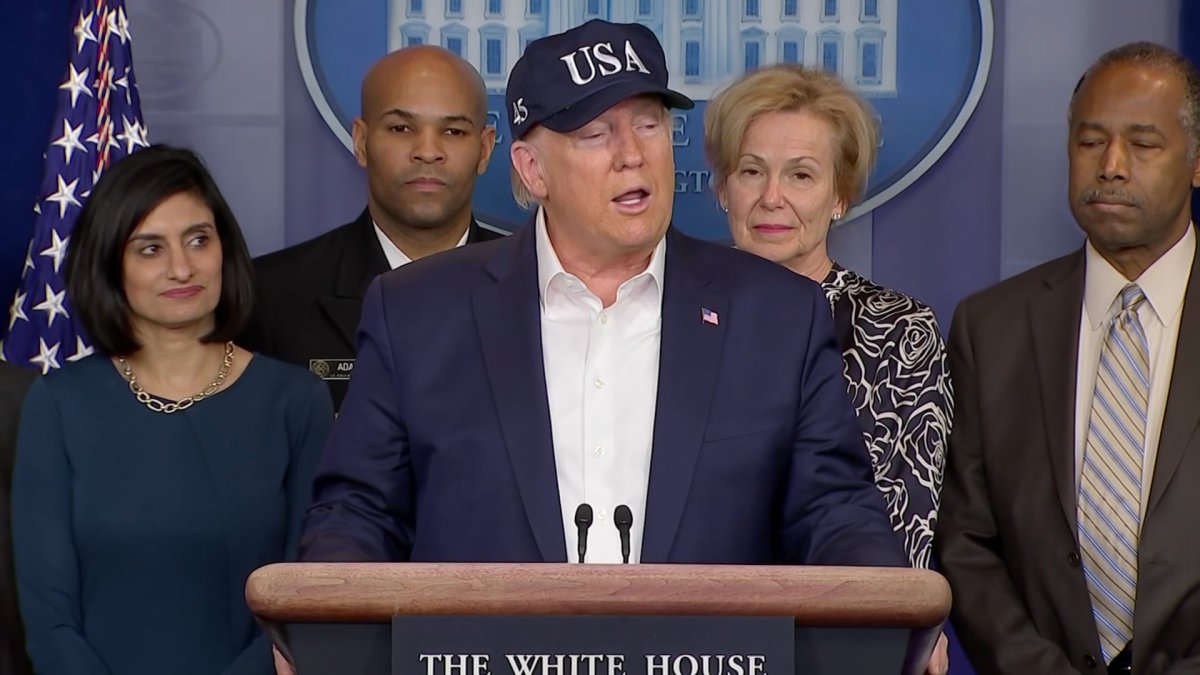

President Trump told reporters on Saturday that he was optimistic about the economy following Friday’s stock market growth and the congressional aid package, predicting a “tremendous bounce” in the wake of the coronavirus. Trump also expressed frustration with the Chairman of the Fed and accused him of “following, not leading” global markets.

The Federal Reserve took emergency action Sunday to help the economy withstand the coronavirus by slashing its benchmark interest rate to near zero and saying it would buy $700 billion in Treasury and mortgage bonds.

The Fed’s surprise announcement signaled its concern that the viral outbreak will depress economic growth in the coming months and that it is prepared to do whatever it can counter the risks. It cut its key rate by a full percentage point — to a range between zero and 0.25% — and said it would keep it there until it feels confident that the economy can survive a sudden near-shutdown of economic activity in the United States.

The central bank will buy $500 billion of Treasury securities and $200 billion of mortgage-backed securities. This amounts to an effort to smooth over market disruptions that have made it hard for banks and large investors to sell Treasuries as well as to keep longer-term rates borrowing rates down. The disruptions in the Treasury market sent the yield on the 10-year Treasury rising last week, an unusual move that threatens to swell borrowing costs for mortgages and credit cards.

On Sunday evening, U.S. stock futures began falling after the Fed's announcement. Futures for the S&P 500 index dropped 4%, while futures for the Dow industrials fell by 3.7%.

All told, the Fed's massive response is intended to keep financial markets functioning and lending flowing to businesses and consumers. Otherwise, as revenue dries up for countless small businesses that have suddenly lost customers, these employers could be forced to lay off workers or even seek bankruptcy protection in some cases.

"This is a break-the-glass moment" for the Fed, said Mark Zandi, chief economist at Moody’s Analytics. "They are throwing everything they’ve got at this. My sense is they must be nervous about the credit system not functioning properly. They are trying to shore up confidence."

By aggressively slashing its benchmark short-term rate and pumping hundreds of billions of dollars into the financial system, the Fed’s moves Sunday recalled the emergency action it took at the height of the financial crisis. Starting in 2008, the Fed cut its key rate to near zero and kept it there for seven years. The central bank has now returned that rate -- which influences many consumer and business loans -- to its record-low level.

As more businesses across the country see their revenue dwindle as consumers stay home, many of them will seek short-term loans to maintain their payrolls. The Fed said it has dropped its normal requirement that banks hold cash equal to 10% of its customers' deposits, thereby allowing banks to lend that money instead. It also said banks can use additional cash buffers that were imposed after the 2008 financial crisis for lending.

"The Federal Reserve," its statement Sunday said, "is prepared to use its full range of tools to support the flow of credit to households and businesses and thereby promote its maximum employment and price stability goals."

"It confirms that the Fed sees the economy going down ... very sharply" toward recession, said Adam Posen, president of the Peterson Institute for International Economics, said.

The Fed said it has also cut interest rates on dollar loans in a joint action with five central banks overseas. This move is intended to ensure that foreign banks continue to have access to dollars that they lend to overseas companies.

All told, the Fed's actions amount to a recognition that the U.S. economy faces its most perilous juncture since the recession ended more than a decade ago.

Coronavirus Outbreak Coverage

Yet with the virus' spread causing a broad shutdown of economic activity in the United States, the Fed faces a hugely daunting task. Its tools — intended to ease borrowing rates, facilitate lending and boost confidence — are not ideally suited to offset a fear-driven shutdown in spending and traveling.

"We have to hope that the Fed getting out in front of events, not to mention other central banks, pushes the economy in the right direction," Posen said. “The heavy lifting for stimulus and for preventing lasting economic damage has to be done on the fiscal side. That’s nature of this shock.’’

Posen said he favors actions that are outside the Fed's purview, such as providing sick leave and pay for quarantined workers and rolling over bank loans to small and medium-sized businesses hit hard by the outbreak.

"This isn’t going to be the magic bullet that saves everything," said Timothy Duy, an economist at the University of Oregon who follows the Fed, but sends a signal to Congress that the economy needs emergency stimulus.

Duy predicted that the Fed will follow up with further actions, including possibly changing its inflation target to allow for more stimulus and providing more support for commercial paper — the short-term notes that companies issue to meet expenses.

"I don’t think they’re done yet," Duy said.

Duy said the asset purchases are an "effort to keep markets from freezing up."

Earlier Sunday, Treasury Secretary Steven Mnuchin said that both the central bank and the federal government have tools at their disposal to support the economy.

Mnuchin also said he did not think the economy is yet in recession. Many leading economists, though, have said they believe a recession has either already arrived or will soon. JPMorgan Chase predicts the economy will shrink at a 2% annual rate in the current quarter and 3% in the April-June quarter.

"I don't think so," Mnuchin said, when asked if the U.S. is in recession. "The real issue is what economic tools are we going to use to make sure we get through this."

On Saturday, President Donald Trump reiterated his frequent demand that the Fed "get on board and do what they should do," reflecting his argument that benchmark U.S. rates should be as low as they are in Europe and Japan, where they're now negative. Negative rates are generally seen as a sign of economic distress, and there's little evidence that they help stimulate growth. Fed officials have indicated that they're unlikely to cut rates below zero.

Two weeks ago, in a surprise move, the Fed sought to offset the disease's drags on the economy by cutting its short-term rate by a half-percentage point — its first cut between policy meetings since the financial crisis.

The Fed's policymakers have largely accepted research that says once its benchmark rate approaches zero, it would produce a greater economic benefit to cut all the way to zero rather than just to a quarter- or half-point above. That's because it takes time for rate cuts to work their way through the economy. So if a recession threatens, quicker action is more effective.

On Thursday, the central bank said it would provide $1.5 trillion of short-term loans to banks. The central bank will provide the cash to interested banks in return for Treasuries. The loans will be repaid after one or three months.

That program was an early response to signs that the bond market has been disrupted in recent days as many traders and banks have sought to unload large sums of Treasurys but haven't found enough willing buyers. That logjam reduced bond prices and raised their yields — the opposite of what typically happens when the stock market plunges.

The Fed also said last week that it would broaden its $60 billion monthly Treasury purchase program, launched last fall, from just short-term bills to all maturities. The Fed is already reinvesting $20 billion from its holdings of mortgage-backed securities into Treasuries of all durations, thereby bringing its total purchases to $80 billion.

Those purchases would help relieve banks of the Treasuries they want to sell. Some analysts expect the Fed to extend those purchases past their current end-date of the second quarter and even vastly increase the size.