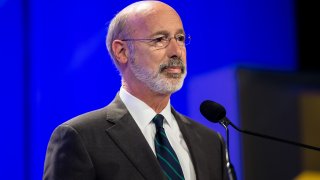

What to Know

- Pennsylvania Gov. Tom Wolf will announce his budget for the coming state fiscal year Wednesday.

- Wolf's budget director told the Associated Press the plan includes a tax increase on top earners to help fund public schools.

- Schools could receive a share of nearly $2 billion to help cover their costs like teacher salaries, operations and supplies.

Gov. Tom Wolf will propose a sweeping new plan to dramatically boost funding for public schools, to be supported by an increase in the state's personal income tax rate, administration officials said Tuesday.

Wolf's administration began releasing details of the plan to The Associated Press ahead of Wednesday's planned budget address.

Under the plan for the fiscal year beginning July 1, Wolf, a Democrat, will ask the Republican-controlled Legislature for what could approach $2 billion extra for public schools.

Get Philly local news, weather forecasts, sports and entertainment stories to your inbox. Sign up for NBC Philadelphia newsletters.

The biggest part of that, $1.35 billion, would be distributed to schools to pay for their primary operations, like teacher salaries, operations costs and supplies, on top of the $6.8 billion they currently receive, Jen Swails, Wolf's budget secretary, said in an interview.

The majority of that $8.1 billion would go out through a 5-year-old school funding formula designed to iron out inequities in how Pennsylvania funds the poorest public schools. A portion of it would ensure that no school district receives less than it does now, officials said.

Schools also would receive another $200 million for special education aid, on top of the $1.2 billion they currently receive, in addition to other sums of money, Swails said.

Politics

The personal income tax increase would take the rate to 4.49% from 3.07%, but increase the exemption for the lowest earners, the people said.

Under that scenario, the lowest earners — about 40% of the total — would pay less in income tax, while approximately the top one-third of taxpayers would pay more, Swails said.

Lawmakers last approved an increase in the tax in 2004. The governor's plan to increase the personal income tax would raise about $3 billion extra, Swails said.

That is an increase of more than 20% when compared with 2019, the last fiscal year before the pandemic disrupted the economy and tax deadlines.

The rest of the money would go to help plug a projected multibillion-dollar deficit in the state’s operations, Swails said.