NBC10 is one of dozens of news organizations producing BROKE in Philly, a collaborative reporting project on solutions to poverty and the city’s push toward economic justice. Follow us at @BrokeInPhilly.

Home sale prices in Philadelphia rose dramatically in 2020, up nearly 13% overall and even moreso in neighborhoods not traditionally known for steep increases, according to the quarterly analysis by Drexel University economist Kevin Gillen.

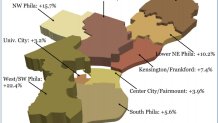

In Southwest Philadelphia, for instance, average home prices rose 22% in the last year. In North Philadelphia, prices rose 17%. Outer neighborhoods far outpaced the city's traditional areas for growth, like Center City, Fishtown and South Philadelphia.

"Historically speaking, every time I do this report, the greatest growth has been in Center City. The least growth has been farther away," Gillen said of the city's outer neighborhoods. "That growth has reversed. I’ve never seen appreciation in the outer neighborhoods as I’ve seen now."

Get Philly local news, weather forecasts, sports and entertainment stories to your inbox. Sign up for NBC Philadelphia newsletters.

Still, taken as a whole, the 12% annual rise in home sale prices for the entire city outpaced the national average for American cities, and Gillen said he is impressed by the resilience of Philadelphia's housing market during the coronavirus pandemic.

"We’re much more affordable than them. The New York, San Francisco, Washington D.C. and Los Angeles markets are very expensive already and they become less appealing, much so, during the pandemic," he said of other large cities.

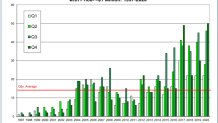

Two reasons fueling the skyhigh real estate prices are historically low inventory -- the city usually has about 7,400 units on the market in any given month, but averaged about 2,500 in the last three months of 2020 -- and still-low interest rates.

But the high prices that continued through the end of 2020, combined with already rising sales prices earlier in the pandemic year, have Gillen worried about the future.

There are several factors that give him pause:

- Real estate markets tend to rise in 5-7 year cycles, and the current cycle in Philadelphia is now in its ninth year.

- Sale prices that outpace increases to household income and a city's population usually signal trouble ahead.

- The potential for a flood of foreclosures later this year after government-mandated moratoriums could dilute the overall housing market.

"I’m concerned that the price appreciation is not sustainable. Rising house prices can be a good or bad thing. If they are rising because fundamentals are improving, that’s a good thing," Gillen said. "If house prices are going up, but incomes and population aren’t going up, then you’re either going to have a correction or you’re going to move to a permanent level of being a less affordable city."

That latter outcome is what has happened in recent decades, most notably, in San Francisco and New York City.

"People won’t ever own homes or people will have to spend more of their income on housing," Gillen said of the potential effect from rapidly rising home prices.

In West Philadelphia's neighborhoods, the average home price went from $85,000 a year ago to about $120,000 in the newest survey.

It's a stunning rise for a single year, particularly amid an unprecedented pandemic, Gillen said.

"Quite frankly, I couldn't believe it," he said. "If you asked me a year ago where the market would be today, I wouldn't have predicted this."

Million-dollar sales in Philadelphia also hit a record-high in the last three months of 2020, Gillen's report found, joining a record-high for $1 million homes sold in the city's suburbs the previous quarter. And the location of those sales in Philadelphia are more spread out than ever.

"I see them spreading out. If I showed you a map like that 5 years ago, they would be tighter in areas," he said. "They’re a little more dispersed than they used to be."

All told, it's a seller's market, and yet few homeowners appear willing to sell at the moment, Gillen said.

Realtors have told him that the small inventory may open up a bit as the coronavirus is tamed in the months ahead, and people are willing to let strangers and realtors into their homes to take a tour.

"If we hit that point by spring or summer, we could see inventory come up and restore some balance," Gillen said.