When it comes to foreclosed homes, an often overlooked issue is the impact that the abandoned property will have on everything that surrounds it. But that issue certainly was not ignored by those who live near an abandoned house on 635 Grant Street in Allentown. In fact, the gradual collapse of the property impacted the entire block.

“My concern was that somebody was going to get hurt or the roof was going to fall down and hit one of the kids,” said Migdalia Cruz, who lives nearby the home.

After the real estate market collapsed under the weight of foreclosures, Allentown had to deal with more than 600 abandoned houses that were dragging down neighborhoods.

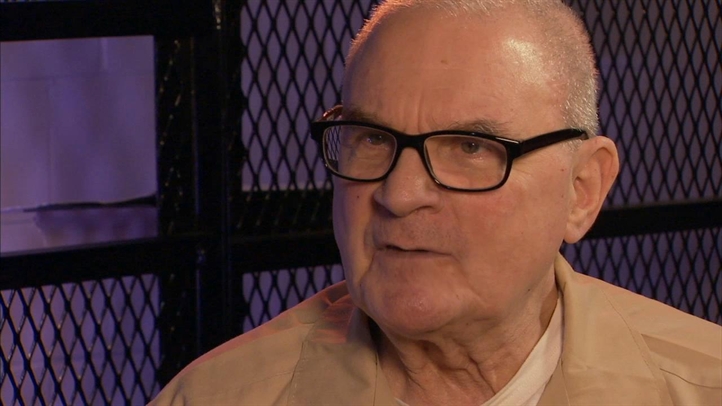

“We would have the name of the legal owner of a property,” said David Paulus, the Allentown Building Standards Director. “But if we could contact them, their answer was usually, ‘I’m losing this property in foreclosure and i don’t live there anymore. I don’t want to have anything to do with it. You’ve got to deal with the banks.’”

To fix this problem, Allentown’s City Council passed a law last December, requiring banks and mortgage companies to register all foreclosures, making it easier for the city to find property owners if the home falls into disrepair. The law also makes banks liable to maintain the property on bank-owned properties and requires mortgage companies to file default loans with the city, according to the Express Times. The law in essence makes the companies responsible for the upkeep and repair of the foreclosed properties.

After the law passed, repairs were made to several abandoned homes, including the collapsing house on Grant Street.

“I thought it was great,” said Cruz. “I was happy because I’ve been here eight years and I never saw anything done. But finally something was done!”

Local

Breaking news and the stories that matter to your neighborhood.

The success of the program has inspired other cities in the area. Easton, Reading and Bethlehem are all exploring their own versions of the foreclosure cleanup law.