U.S. stocks jumped on Tuesday with the S&P 500 hitting a new record, as the market's historic rally extended to December.

The Dow Jones Industrial Average climbed 185.28 points, or 0.6%, to 29,823.92. The 30-stock gauge jumped more than 400 points at its session high to a new intraday record. The S&P 500 rose 1.1%, or 40.82 points, to 3,662.45, marking a fresh record closing high. The tech-heavy Nasdaq Composite gained 1.3%, or 156.37 points, to 12,355.11, also notching a record close.

Apple popped 3.1% to lead the 30-stock Dow higher. Communication services and financials were the best-performing sectors in the S&P 500, rising at least 1.6% each.

Sentiment got a lift after a group of lawmakers unveiled a $908 billion stimulus plan, which includes more than $200 billion in Paycheck Protection Program small business loans. The news gave stocks a boost, and pushed the 10-year Treasury yield above 0.9%. However, Senate Majority Leader Mitch McConnell did not endorse the bipartisan plan, saying he wants to pass a "targeted relief bill" instead.

"Investors have focused … on the potential for a return to normal social and economic activity based on the widespread rollout of effective vaccines in the first half of 2021," said Mark Haefele, CIO of UBS Global Wealth Management, in a note. "We see further upside for global equities in this environment, but also expect market leadership to continue to shift."

'Strong finish for 2020' ahead

Money Report

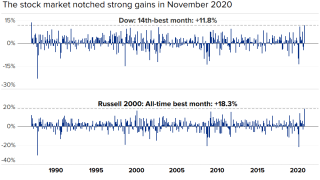

The Dow rallied 11.8% in November, posting its best one-month performance since January 1987. The S&P 500 and Nasdaq Composite rose 10.8% and 11.8%, respectively, for their strongest monthly advances since April. After November's gain and Tuesday's pop, the S&P 500 is up 13.8% for 2020.

"December looks like it will be a very strong finish for 2020," wrote Tom Lee of Fundstrat Global Advisors, who cited data that showed during bull markets when the S&P 500 was up more than 10% through November for the year, it always added to that gain in December.

The data "confirms our view that strong markets finish strong," said Lee.

November's rally came amid a slew of positive coronavirus vaccine news, which lifted hope of a strong economic recovery. In the latest development on that front, Pfizer and BioNTech applied to the European Medicines Agency for conditional marketing authorization of their coronavirus vaccine, potentially enabling the vaccine to be used in Europe before the end of 2020.

Last month's rally was led by value stocks that hinge on an economic comeback. The iShares Russell 1000 Value ETF (IWD) rallied 13.4% for the month, and outpaced its growth counterpart, the iShares Russell 1000 Growth ETF (IWF), by more than 3 percentage points. The small-cap Russell 2000 had its best month ever, rising more than 18%.

"Vaccine news has further buoyed spirits with several therapeutic/preventative lights now at the end of the pandemic tunnel being another set of positive data points," wrote Tobias Levkovich, chief U.S. equity strategist at Citi. However, he added investors may be getting too complacent about the risks the market still faces.

Federal Reserve Chairman Jerome Powell and Treasury Secretary Steven Mnuchin spoke before Congress on Tuesday, with Powell calling the U.S. economic outlook "extraordinarily uncertain."

"The rise in new COVID-19 cases, both here and abroad, is concerning and could prove challenging for the next few months," Powell said. "A full economic recovery is unlikely until people are confident that it is safe to reengage in a broad range of activities."

Data compiled by Johns Hopkins University shows that more than 13 million Covid-19 cases have been confirmed in the U.S. along with over 266,000 deaths. In New York, Gov. Andrew Cuomo said the state was implementing emergency hospital measures as cases continue to rise.

Janet Yellen, President-elect Joe Biden's nominee for Treasury secretary, noted Tuesday that it is "essential that we move with urgency. Inaction will produce a self-reinforcing downturn, causing yet more devastation."

In corporate news, Tesla's shares popped 3% after S&P Dow Jones Indices said on Monday night the electric-car maker will be added to the S&P 500 on Dec. 21 in a single step despite its large size. The index provider had considered adding the $500 billion stock in multiple phases.

Shares of Zoom Video fell 15.1% despite the video-conferencing giant reporting better-than-expected earnings for the third quarter.

— CNBC's Yun Li contributed reporting.

Subscribe to CNBC PRO for exclusive insights and analysis, and live business day programming from around the world.