The S&P 500 rose to its highest level in five months on Thursday as better-than-expected Meta results further improved sentiment around technology shares, which led the market lower last year.

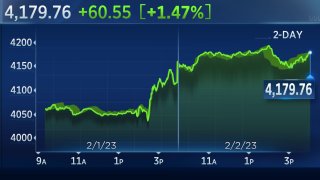

The broader market index jumped 1.47% to 4,179.76, or its best level since August. Meanwhile, the tech-heavy Nasdaq Composite advanced 3.25% to 12,200.82, or its highest level since September. The gains come ahead of a trio of Big Tech results after the bell in Apple, Amazon and Alphabet.

At the same time, the Dow Jones Industrial Average underperformed, falling 39.02 points, or 0.11%, to 34,053.94. The major index was dragged lower by Merck shares after the pharmaceutical firm issued a weak outlook in its latest earnings results, despite beating analysts' estimates on the top and bottom lines.

Get Philly local news, weather forecasts, sports and entertainment stories to your inbox. Sign up for NBC Philadelphia newsletters.

Some momentum came out of the day's earlier gains as bond yields traded off their lows. The S&P 500 was up 1.85% at one point. January's jobs report looms Friday.

Meta surged 23% in its best day since 2013 after reporting a fourth-quarter beat on revenue and announcing a $40 billion stock buyback. That helped investors look past losses in the business unit overseeing the metaverse.

Other mega-cap tech stocks rose on the back of those results. Shares of Google-parent Alphabet were up nearly 7.3%, while Amazon jumped about 7.4%. Apple shares gained 3.7%.

Money Report

Tech stocks have outperformed in 2023, buoyed by recent signals of cooling inflation that investors expect could lead to a pause from the Federal Reserve in its aggressive rate hiking campaign. The S&P 500 information technology sector is up more than 14% this year after a decline of more than 28% last year.

"It's showing that growth is outperforming value as it unwinds some of the pressures that hawkish rhetoric brought to risk markets over the course of 2022," said Keith Buchanan, senior portfolio manager at GLOBALT Investments.

Wall Street is coming off a winning session after the Fed on Wednesday announced a 0.25 percentage point interest rate hike. While the central bank gave no indication of an upcoming pause in rate hikes, investors were encouraged by the smaller increase and Chair Jerome Powell's comments recognizing easing inflation.

Economists, on average, expect Friday's payrolls data to show 187,000 jobs were added in January, according to Dow Jones estimates. Though, Thursday afternoon Goldman economists said payrolls could be as high as 300,000, a big number that could mean the Fed has further to go to cool the economy and curb inflation.

Lea la cobertura del mercado de hoy en español aquí.

S&P 500 closes higher Thursday

The S&P 500 closed higher Thursday after rising to its best level in five months. The broader market index jumped 1.47%, while the tech-heavy Nasdaq Composite advanced 3.25%.

Meanwhile, the Dow Jones Industrial Average underperformed, falling 39.02 points, or 0.11%.

— Sarah Min

Analysts predict certain stocks will decline despite strong starts in 2023

The S&P 500 is headed toward another positive week, following its strongest January showing since 2019. However, analysts believe some stocks are getting ahead of themselves and are set to fall.

As of Thursday afternoon, the broad market index is up more than 2% for the week. The Nasdaq Composite surged nearly 5%, while the Dow Jones Industrial Average oscillated around the flat line.

Investors' optimism that the Federal Reserve will soon ease up on its monetary policy has fueled the rise in the major indexes, despite Chairman Jerome Powell saying it is "premature" to declare victory on inflation.

The tech stock rally has also contributed to the benchmark indexes' gains in 2023. For example, Meta shares have jumped nearly 30% this week, surging after the social media company posted a quarterly revenue beat. Shares are up more than 60% for the year.

Nonetheless, analysts don't expect many stocks to sustain their early-year momentum, cautioning that investors are being too optimistic about the Fed's stance on inflation.

We used FactSet data to screen for S&P 500 stocks whose consensus price targets indicate an expected decline.

To read more about which stocks made the list, click here.

— Hakyung Kim

Investors may be 'caught offsides' by strong tech earnings, iShares strategist says

The large rally in tech stocks to start the year, which has accelerated on Thursday, comes after a stream of outflows from tech-heavy ETFs like the Invesco QQQ Trust.

"There's a potential that those outflows could be caught offsides if we see a continuation of the trend where tech has actually done a little bit better than expected," said Kristy Akullian, senior iShares strategist at BlackRock.

However, Akullian said that the reemergence of the tech trade is likely to be short-lived, even as the Fed's rate hiking cycle appears to be reaching its ceiling.

"Even though yesterday Chair Powell came out and sounded a little bit more dovish than has in the past, our view is still that we think inflation is not going to decline as rapidly as market expectations, and I would say equity valuations, currently imply," Akullian said.

Strategists at iShares still value over growth and see continued upside for the energy sector, Akullian said.

— Jesse Pound

Cathie Wood's ARK Innovation ETF has best day since November 2022

Cathie Wood's ARK Innovation ETF is up close to 7%, putting it on track for its best daily performance since last November.

As of 2 p.m. ET on Thursday, the innovation-focused fund has rallied 11.7% since the start of the week. This also continues its six-week positive streak, during which it has gained almost 46%.

Ark's strong 2023 rally has been driven by Coinbase, which gained 24.2% today and 33.3% week-to-date. Coinbase shares jumped after a Manhattan federal judge dismissed a class-action suit against the company.

Other major contributor's to the ETF's growth include Invitae Corp, Unity Software and Ginkgo Bioworks.

— Hakyung Kim

Goldman sees big jump in jobs in January, due to fewer layoffs and return of striking workers

Goldman Sachs economists predict an above consensus 300,000 jobs were created in January because they so far see no signs of a major jump in layoffs.

According to Dow Jones survey, economists are predicting 187,000 nonfarm payrolls were added, compared to 223,000 in December.

The Goldman economists note other forecasters have been expecting a much lower number because of the spike in corporate layoff notices, particularly at tech firms. But so far jobless claims have fallen even more, and data from California suggests the majority of layoffs have not yet occurred.

"Our well-above-consensus forecast also reflects strength in Big Data employment indicators, a boost from favorable seasonal factors that are spuriously fitting to last winter's Omicron wave, still-elevated labor demand, and a 36k boost from the return of striking education workers," the Goldman economists wrote. "On the negative side, ADP's employment data flagged possible disruptions from winter weather and California flooding."

--Patti Domm

Morgan Stanley's Shallet says market is 'extraordinarily overbought'

Investors are setting themselves up for trouble by betting on the strong stock market rally in 2022, according to Lisa Shallet, chief investment officer at Morgan Stanley Investment Management.

As investors bet on the Federal Reserve halting its rate hikes soon, Shallet said they instead should be worried about liquidity being sapped from the market and causing another downturn.

"The market is extraordinarily overbought. We know we broke through some positive technicals. We think a lot of that is being driven by liquidity," Shallet said in an interview. "But we think folks buying in here are buying into yet another bear market rally. This feels so much like January of 2000, where everyone said the worst is behind us and it was only the beginning."

Shallet said she thinks the market is misreading the Fed, which she expects to hold interest rates higher to fight inflation. A resilient labor market and fairly strong economy will allow the central bank to maintain a higher-for-longer approach, she added.

Markets currently are betting that the Fed is nearly done with rate hikes and will start cutting before the end of the year.

"The U.S. economy is perfectly fine to absorb rates that are close to 5%," Shallet said.

—Jeff Cox

Healthcare stocks fall on proposal for lower 2024 Medicare Advantage rates

A slew of healthcare and medical insurance stocks tumbled after the Centers for Medicare and Medicaid Services shared early plans for lower-than-expected rates for Medicare Advantage plans in 2024.

UnitedHealth and Humana shares dropped more than 5% each on the news. Cigna and Elevance Health shares were last down about 4% each. CVS Health dipped 1.7%.

— Samantha Subin

S&P 500, Nasdaq Composite at session highs

The S&P 500 and Nasdaq Composite reached session highs during early afternoon trading Thursday. The broader market index jumped 1.62%. Meanwhile, the tech-heavy Nasdaq Composite rallied 3.5%.

— Sarah Min

Apple could have a 'good report,' not a 'great report,' investor says

Apple is a buying opportunity ahead of its earnings report after the bell Thursday, according to Bokeh Capital Partners' Kim Forrest.

The tech giant dealt with several challenges in its most recent quarter, including lower shipments of its higher-end iPhone models following shutdowns in its assembly plant in China for weeks due to Covid shutdowns.

"What I'm hearing from analysts is, they're playing the game, 'how low can we go?' because this has been a catastrophic sort of quarter. Everything going wrong for Apple," Forrest said Thursday on CNBC's "The Exchange." Forrest noted she has a three-to-five year investment horizon.

"I'll take the opposite on that trade. What if something went right, and they actually exceed their low earnings? I think that's a likelihood here with Apple being a grown up in the world of managing the analysts. So, I think that they will be able to report a good report, not a great report," Forrest added.

Apple shares are up more than 3% during Thursday trading.

— Sarah Min

Stocks making the biggest moves during midday trading

Here are some of the companies making the biggest moves during midday trading.

Meta — The tech giant's shares jumped 25% by the middle of the trading day, on track for its strongest day in nearly a decade. Late Wednesday, Meta reported revenue that topped analysts' expectations and announced a $40 billion stock buyback plan. Firms also responded positively to Meta's earnings report, with Bank of America and Goldman Sachs rating the stock a buy. Meta shares sit at their highest point since September 2022.

FedEx — Shares advanced 6.4% after the shipping company announced it was laying off 10% of its officers and directors. Analysts at Citi and Bank of America applauded the decision, saying the company was getting its costs under control as demand slid. Both firms upgraded the stock to buy from neutral.

Coinbase — Shares of the cryptocurrency exchange operator surged 20% after a class-action suit against Coinbase was dismissed by a Manhattan federal judge.

Check out the full list here.

— Hakyung Kim

More companies have raised guidance than lowered this earnings season, Bespoke Investment Group says

Stocks may be rallying for a different reason than the Federal Reserve, according to Bespoke Investment Group.

"It may be less about Powell and more about earnings season," read a tweet from the firm, which said that, "Surprisingly, more companies have now raised guidance than lowered guidance so far this season -- not what investors were expecting..."

More than 380 stocks have reported earnings this season through Wednesday morning, averaging a one-day gain of 1.62% in the first trading day after posting results, the firm said.

Meanwhile, stocks that have reported results over the last three months have seen robust gains, according to the firm. The median one-day gain following results was 0.86%.

"We haven't seen this type of strength on a rolling 3-month basis since the Q2/Q3 2009 reporting periods coming out of the Financial Crisis," read the tweet.

— Sarah Min

Communication services, consumer discretionary stocks outperform

Communication services and consumer discretionary stocks were the leading sectors in the S&P 500 Thursday, as investors bought up riskier assets following Federal Reserve Chair Jerome Powell's latest comments on inflation.

Communication services jumped more than 6% during midday trading. The sector was boosted by Meta Platforms shares, which were up more than 24% after its latest earnings results. Shares of Lumen Technologies and Alphabet also surged.

Consumer discretionary stocks advanced more than 3%. The top performing stocks in the sector include Amazon and Tesla, each more than 6% higher.

— Sarah Min

Oppenheimer downgrades Match Group, says dating company is a 'show me' story

Oppenheimer is losing some of its confidence in shares of Match Group as its Tinder platform struggles with paying subscriber losses.

Analyst Jason Helfstein downgraded shares of the dating company to a perform rating and suspended his price target, noting that subscribers losses and comments from management may signal dating is not as downturn-resistant as initially expected.

"While MTCH unveiled an encouraging product roadmap and evidence of improved à la carte revenue, stock is now a 'show me story' after losing a record number of paid subs (~500K), stoking bear concerns that US/Europe online dating is maturing," he wrote in a Wednesday note to clients.

Tinder lost about 300,000 paying subscribers in the fourth quarter as it weeded out lower-priced tiers. This may signal a "maturing business that has passed its peak," Helfstein wrote.

President and Chief Financial Gary Swidler said during a fourth-quarter earnings call that the company's long-term goal of attaining more optimal price points, or fewer payers at higher pricing, is having an "adverse effect" on those Tinder figures.

— Samantha Subin

FedEx shares gain on Citi, Bank of America upgrades

Shares of shipping giant FedEx rose more than 5% after analysts at both Citi and Bank of America upgraded shares to buy ratings.

Analysts at both Wall Street firms cited increasing confidence in the company's costing cutting capabilities after it announced plans to trim its officer and manager headcount by 10%.

Read more on the calls here.

— Samantha Subin

Bank of America downgrades First Solar

First Solar shares dipped more than 2% after Bank of America downgraded shares to neutral from a buy rating, saying that benefits from the Inflation Reduction Act are priced in.

"Between the outperformance of the shares and weakness in global solar prices of late, the favorable drivers are largely embedded," wrote analyst Julien Dumoulin-Smith in a Thursday note.

CNBC Pro subscribers can read more on the call from Bank of America here.

— Samantha Subin

Rivian shares rise after electric truck maker says it will lay off 6% of workers

Rivian shares rose more than 9% on Thursday after the electric truck maker said it's laying off 6% of its workers as it prepares for a possible price war in electric vehicles.

CEO RJ Scaringe said boosting the company's operating efficiency is a "core objective," according to an email sent to employees that was seen by CNBC on Wednesday. Reuters first reported on details of Scaringe's email.

— John Rosevear, Sarah Min

Charlie Munger says the U.S. should ban cryptocurrencies

Berkshire Hathaway Vice Chairman Charlie Munger urged the U.S. government to ban cryptocurrencies like China, saying a lack of regulation enabled wretched excess and a gambling mentality.

"A cryptocurrency is not a currency, not a commodity, and not a security," the 99-year-old Munger said in an op-ed published in The Wall Street Journal on Wednesday evening.

"Instead, it's a gambling contract with a nearly 100% edge for the house, entered into in a country where gambling contracts are traditionally regulated only by states that compete in laxity," Munger said. "Obviously the U.S. should now enact a new federal law that prevents this from happening."

— Yun Li

Ray Dalio says cash is more attractive than stocks and bonds

Billionaire investor Ray Dalio renewed his belief that cash makes an attractive investment, saying it's become more appealing than stocks and bonds amid rising rates.

"Cash used to be trashy. Cash is pretty attractive now," Dalio said on CNBC's "Squawk Box" Thursday. "It's attractive in relation to bonds. It's actually attractive in relation to stocks."

The founder of Bridgewater, one of the world's largest hedge funds, said we are now in the 12th and a half cycle since 1945, where real interest rates have shot up on the back of the Federal Reserve's aggressive rate hikes.

— Yun Li

Carvana surges 40% in post-Fed run

Shares of Carvana jumped 40% Thursday in a blistering run as investors piled into the online used car retailer.

The surge may be due to increased risk appetite after the Federal Reserve's Wednesday meeting and 25 bps rate hike. Chair Jerome Powell said in his press conference that he sees signs of disinflation, which may be giving investors the green light to snap up riskier assets.

Carvana plunged in 2022, but has made quite the comeback this year. So far, it is up more than 106% year to date, including today's gains.

—Carmen Reinicke

S&P 500, Nasdaq open higher Thursday

The S&P 500 and Nasdaq opened higher Thursday after Meta's latest results boosted sentiment around technology shares.

The broader market index jumped 0.9%, while the tech-heavy Nasdaq Composite gained nearly 2%. Meanwhile, the Dow Jones Industrial Average dipped 20 points, or about 0.1%.

— Sarah Min

Bank of America upgrades Meta Platforms, cites focus on efficiency

Meta Platforms' focus on efficiency should bode well for the social media stock, according to Bank of America.

The Wall Street investment bank upgraded shares to a buy from a neutral rating and lifted its price target, suggesting shares could rally nearly more than 40% from Wednesday's close.

"With the new efficiency mentality, the stock is now positioned for leverage/EPS upside as the ad environment improves," wrote analyst Justin Post.

Shares surged more than 19% premarket after topping fourth-quarter revenue estimates and announcing a $40 billion stock buyback.

Read more on the upgrade from Bank of America here.

— Samantha Subin

Jobless claims come in lighter than expected

The number of first-time filers for unemployment benefits was smaller than expected, according to U.S. government data. Initial weekly jobless claims came in at 183,000, while economists polled by Dow Jones expected a print of 195,000. The data comes a day before the Labor Department releases its monthly nonfarm report, which is expected to show the economy added 187,000 jobs in January.

— Fred Imbert

Stocks making the biggest moves premarket

These are the companies making headlines before the bell:

- Meta — Shares of the Facebook parent surged 19% in early morning trading after the company posted better-than-expected revenue and announced a $40 billion stock buyback when it reported its quarterly results Wednesday evening. Bank of America upgraded Meta Thursday, saying the company's new efficiency mentality positions stock for more than 40% upside. The spike in shares helped pull other mega cap tech companies Amazon and Alphabet up by 4% each.

- Align Technology — The orthodontics company saw its shares rise 14% after its quarterly earnings and revenue beat analyst expectations. Align also said it will repurchase up to $1 billion of its common stock over the next three years.

- Honeywell — Shares of the industrial company fell more than 5% in premarket trading after Honeywell's revenue for the fourth quarter came in short of expectations. The company generated $9.19 billion of revenue, while analysts surveyed by Refinitiv were looking for $9.25 billion. The safety and productivity solutions segment saw sales decline 5% year over year. Honeywell's adjusted earnings per share came in at $2.52, 1 cent above estimates.

Check out the full list here.

— Tanaya Macheel

Bank of England boosts rate by half a point, indicates smaller hikes to come

The Bank of England raised its benchmark interest rate by half a percentage point Thursday and indicated that, while more increases are on the way, they could be smaller.

As expected, the central bank boosted its main bank rate to 4% and softened the language around the move. It dropped the word "forcefully" from its intentions on further hikes, and it also scaled back its fears over a looming recession.

An accompanying economic forecast pointed to a shorter, shallower recession than previously anticipated.

The move comes a day after the BoE's U.S. counterpart, the Federal Reserve, upped its benchmark rate by a quarter point to a target range between 4.5%-4.75%.

—Jeff Cox

Meta shares jump 19% in premarket trading

Meta Platforms shares jumped more than 19% in Thursday premarket trading. Should that gain hold, it would be the biggest one-day gain for the Facebook-parent company since July 25, 2013.

— Sarah Min

Deutsche Bank smashes profit expectations in fourth quarter as higher interest rates bolster revenue

Deutsche Bank on Thursday reported its 10th straight quarter of profit, receiving a boost from higher interest rates and favorable market conditions.

Deutsche Bank reported a 1.8 billion euro ($1.98 billion) net profit attributable to shareholders for the fourth quarter, bringing its annual net income for 2022 to 5 billion euros, a 159% increase from the previous year.

Here are the other quarterly highlights:

- Loan loss provisions stood at 351 million euros, compared to 254 million euros in the fourth quarter of 2021.

- Common equity tier 1 (CET1) ratio — a measure of bank solvency — came in at 13.4%, compared to 13.2% at the end of the previous year.

- Total net revenue was 6.3 billion euros, up 7% from 5.9 billion euros for the same period in 2021 but slightly below consensus estimates, bringing the annual total to 27.2 billion euros in 2022.

- Elliot Smith

Meta earnings show the company is getting back on footing, Munster says

Meta's shares are up more than 19% in after hours trading after the company's earnings beat Wall Street expectations on revenue and included an announcement of a $40 billion stock buyback. The company also gave a guidance for its first quarter that signaled revenue could rise on the year.

The solid quarterly performance was a surprise for Gene Munster of Deepwater Management, but signal's that the Facebook parent is getting back on track, he said on CNBC's "Fast Money."

"The results essentially put investors at ease, and what investors need to know is that Facebook Meta is getting back on their footing," Munster said.

He said the company showed solid daily average users especially in key markets, which is a good thing.

"This allows investors to look at the path forward here," Munster said. He added that the top concerns outlined at the top of the earnings call show that the company is refocusing on what it needs to do to grow.

—Carmen Reinicke

Stocks making the biggest after-hour moves

Check out the stocks making the biggest moves after the bell:

- Align Technology — Shares of the orthodontics company gained 14% after the company beat analysts' estimates in its latest quarter.

- Hologic — The medical product maker gained 1.7% after reporting first-quarter earnings per share above expectations and previous guidance, according to FactSet. Hologic also said its revenue was in line with expectations for the quarter.

- C.H. Robinson — The freight stock dropped 4% after C.H. Robinson missed expectations from analysts polled by Refinitiv for the fourth quarter.

See the full list here.

— Alex Harring

Stock futures open mixed

The three major futures indexes were mixed as trading kicked off.

Shortly after after-hour trading began, Dow futures were down about 0.1%.

On the other hand, Nasdaq 100 and S&P 500 futures gained 1% and 0.4%, respectively.

— Alex Harring