Here are the most important news, trends and analysis that investors need to start their trading day:

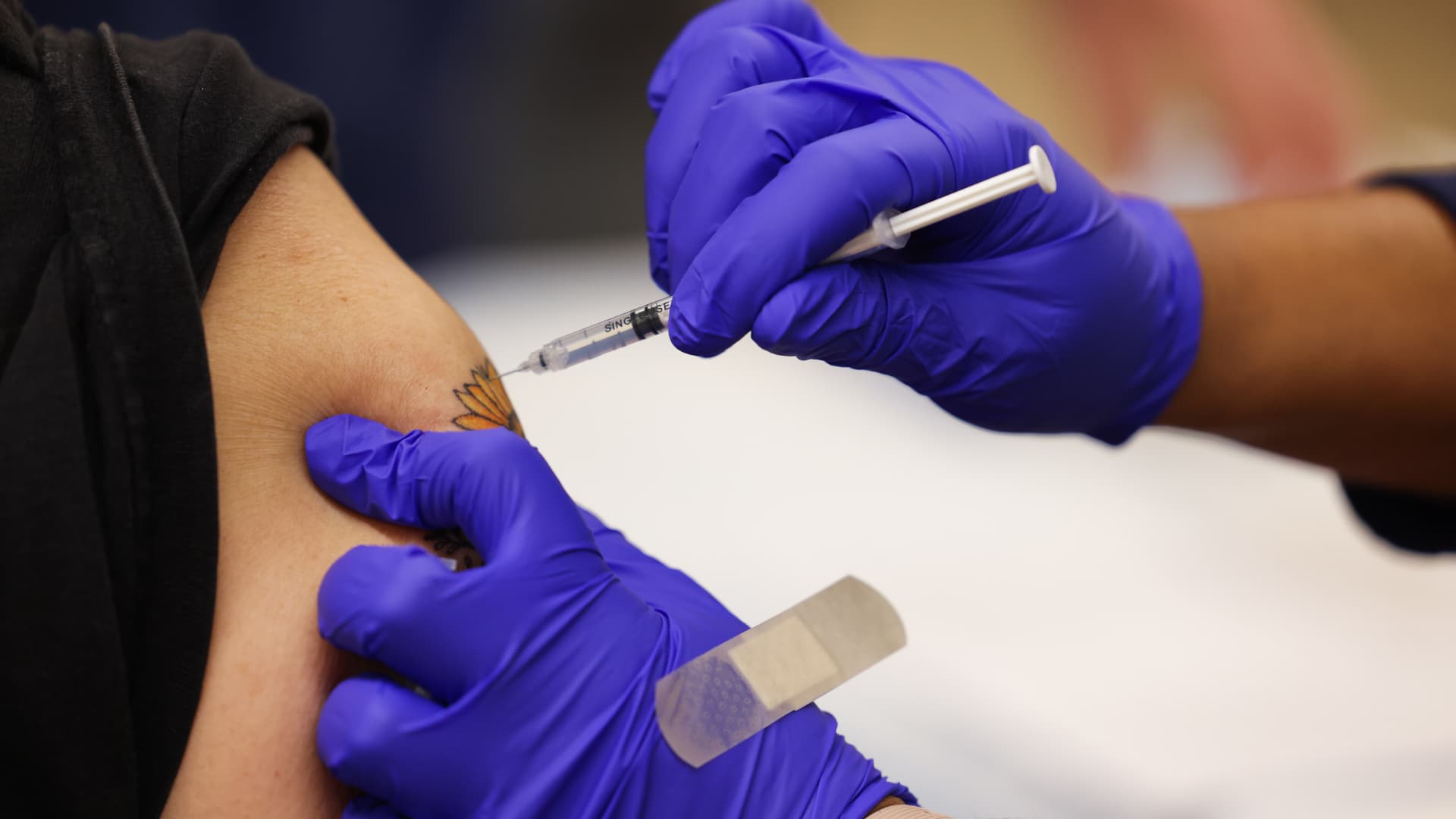

- Wall Street set for another rally as Pfizer booster shows promise on omicron

- Third Pfizer shot against new variant similar to two-dose protection against original

- Meta, formerly Facebook, tells staff they can defer their return to U.S. offices

- Brief drop in mortgage rates causes sudden surge in refinancing

- House takes key step toward raising the debt ceiling as deadline draws closer

1. Wall Street set for another rally as Pfizer booster shows promise on omicron

Get Philly local news, weather forecasts, sports and entertainment stories to your inbox. Sign up for NBC Philadelphia newsletters.

U.S. stock futures reversed higher and pointed to gains for a third day on Wednesday after Pfizer said three doses of its vaccine are effective at neutralizing the omicron variant.

- The Dow Jones Industrial Average on Tuesday rallied 492 points or 1.4%.

- The S&P 500 and the Nasdaq, which both had their best days since March, jumped 2% and 3%, respectively.

This week's gains put all three stock benchmarks back within striking distance of their all-time highs.

- The Dow was nearly 2% away from its November record close.

- The S&P 500 and Nasdaq were 0.4% and 2.3% away, respectively, from their record closes last month.

On Wednesday, at 10 a.m. ET, the government releases the October's JOLTS data, short for Job Openings and Labor Turnover Survey.

Money Report

2. Third Pfizer shot against new variant similar to two-dose protection against original

Pfizer said Wednesday a third Covid vaccine shot produces antibody levels comparable with those induced by the initial two-dose series against the original strain, which are associated with a high level of protection. "Ensuring as many people as possible are fully vaccinated with the first two dose series and a booster remains the best course of action to prevent the spread of COVID-19," Pfizer CEO Albert Bourla said in a joint statement with BioNTech.

3. Meta, formerly Facebook, tells staff they can defer their return to U.S. offices

Meta Platforms, formerly Facebook, said it'll fully reopen its U.S. offices on Jan. 31, but it'll give its employees the option to delay their return by three to five months. The social media behemoth said Tuesday the "office deferral program" is designed to provide its employees with flexibility. In August, Meta said it intended to delay its plan to return U.S. employees to their office until January 2022 due to ongoing concerns with Covid.

4. Brief drop in mortgage rates causes sudden surge in refinancing

A brief drop in mortgage rates, due to the market reaction to the first word of omicron, caused refinance demand to rise a dramatic 9% last week. However, that will likely be short-lived. The home loan interest rate decline wasn't all that big when looking at the weekly average of 30-year fixed-rate mortgages. Homebuyer demand for mortgages fell 5% after four straight weeks of gains, according to the Mortgage Bankers Association. The refinance share of mortgage activity rose to 63.9% of total applications from 59.4% the previous week, Federal Housing Administration data showed.

5. House takes key step toward raising the debt ceiling as deadline draws closer

The House took a first step toward preventing a possible default on U.S. debt. The chamber on Tuesday passed a bill that would allow the Senate to raise the country's borrowing limit with a simple majority vote. Lawmakers attached the provision to legislation that would prevent automatic Medicare cuts set to take place at the end of the year. The measure heads to the Senate where it will need 10 Republican votes to pass and go to President Joe Biden's desk. Treasury Secretary Janet Yellen has estimated the U.S. will hit its debt ceiling on Dec. 15.

— Follow all the market action like a pro on CNBC Pro. Get the latest on the pandemic with CNBC's coronavirus coverage.