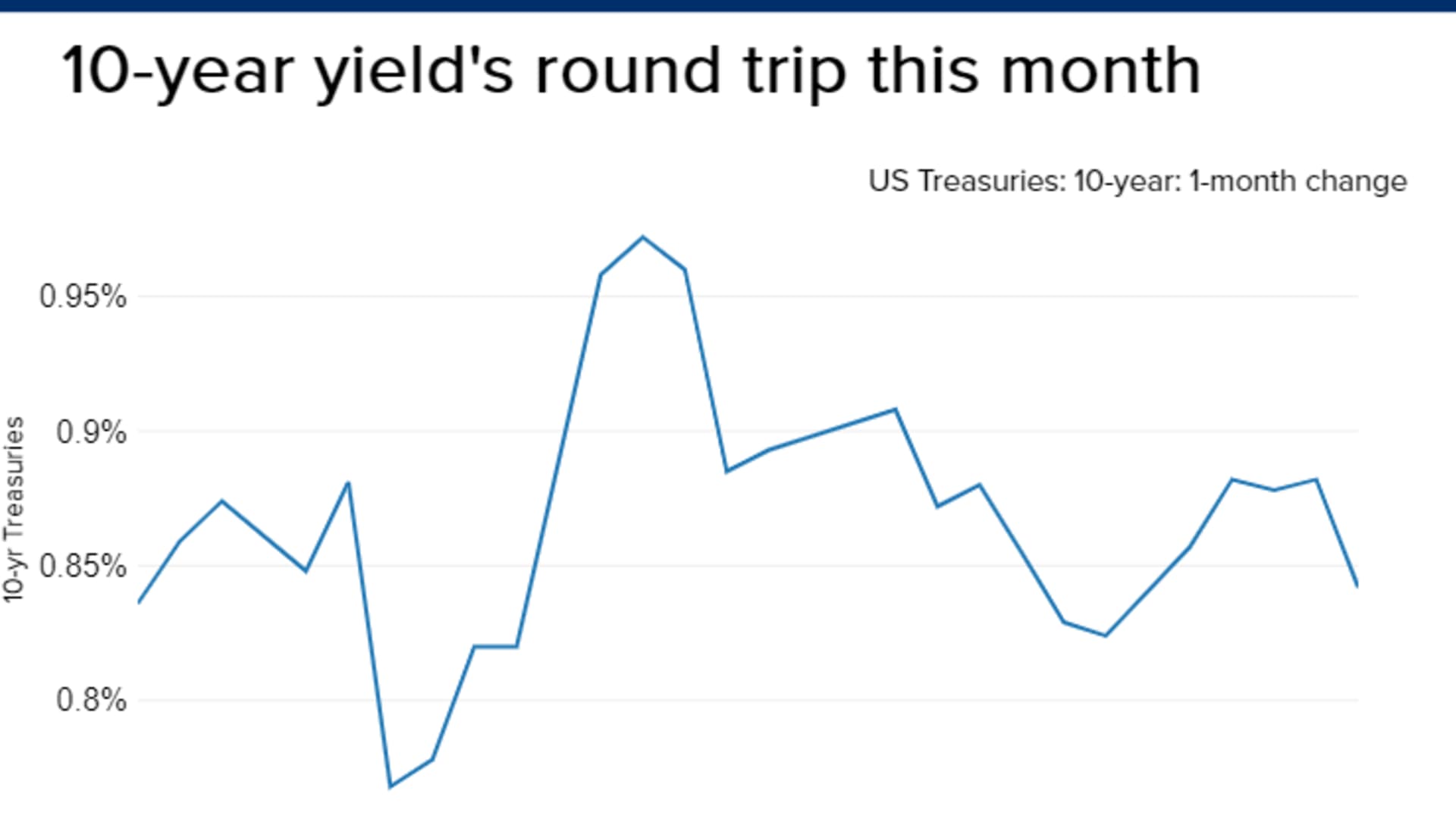

The 10-year Treasury yield was flat on Monday, on pace to finish November flat after a big jump in October.

The yield on the benchmark 10-year Treasury note was little changed at 0.85%, back to the level at the start of this month. The yield on the 30-year Treasury bond was also flat at 1.58%. Yields move inversely to prices.

Earlier this month, the 10-year rate jumped to a high of 0.975%, its highest point since March 20, as a slew of positive news on the coronavirus vaccine front drove investors out of safe assets. The yield has since drifted lower as investors digested the surge in new virus cases that has led to new lockdown restrictions.

The benchmark rate popped more than 17 basis points in October.

The surge in coronavirus infections in the U.S. remained a concern, reaching 13,384,650 on Sunday, according to data compiled by Johns Hopkins University.

"Despite the bountiful uncertainty that will surely characterize the period between now and the end of the year, our bearish aspirations for the long-end found solace in the ability of Treasuries to retrace a good portion of the bull flattening which defined the week just passed," Ian Lyngen, BMO's head of U.S. rates, said in a note on Monday.

Money Report

November data from the Chicago purchasing managers' index is due at 11:45 a.m. ET on Monday, followed by national figures for pending home sales at 12 p.m. ET and the Dallas Fed manufacturing index at 12:30 p.m. ET.

Auctions will be held on Monday for $54 billion of 13-week bills and $51 billion of 26-week bills.