In Springfield Township, Montgomery County, school district officials began the year with more than $21 million in the bank, including millions in reserve accounts dedicated to future costs like pension liability and special education.

Yet the district sought approval to circumvent, if needed, the annual state-mandated amount that the district could raise taxes. By June, after months of budget wrangling and numbers crunching, Springfield adopted a 2016-2017 budget with a tax increase that fell under the limit and didn’t use its state-approved waiver.

Still, seeking exemptions from the Pennsylvania Department of Education has become a familiar move for many of state’s 500 public school districts. Springfield's budget chief, Ken King, said the reason is simple.

“All you have to do is complete the form. That’s it,” King said. “We don’t use exemptions. We don’t like to use them. But you start the budget process in October with very little known. There are a lot of things outside our control. Just to be safe, we file for exemptions.”

One in three districts in Pennsylvania received exemptions to raise property taxes above their state-mandated caps this year, according to documents provided to NBC10.com by the state DOE.

The number of districts that received approvals, 178 this year, has increased from 165 in 2014-2015 and 173 in 2015-2016, the documents show. It is unclear how many used the exemptions to raise taxes above their caps.

The findings come as the Commonwealth Court gets set to hear one of the most important cases regarding local districts’ taxing powers in recent memory. In early December, the court will hear Lower Merion School District’s appeal to a lower court ruling that the district improperly stashed millions of dollars in reserve accounts while continuing to raise taxes each year.

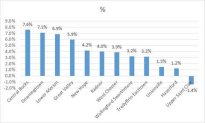

Lower Merion is one of the numerous districts to be allowed tax increases above the state cap each of the last three years, despite having more than $55 million in reserve funds.

Source: Each district’s audited financial statements.

In total, the state’s 500 districts had $4.3 billion in reserve accounts as of the 2014-2015 school year, according to analysis by the Commonwealth Foundation, a conservative think tank.

Local

Breaking news and the stories that matter to your neighborhood.

The group released a report Wednesday that found 46 districts, including Lower Merion and Springfield, have applied for and been granted cap exemptions in at least 8 of the last 10 years.

Even if some districts don’t use the exemptions to raise taxes above district caps, Commonwealth Foundation senior policy analyst James Paul said the process takes decision-making out of the hands of the taxpayers.

“Pennsylvanians have the right to know if their school districts are holding millions in reserve while asking for even more of their hard-earned money,” Paul said. “It’s one thing for districts to plan responsibly for the future; it’s quite another to expect taxpayers to fund massive cash stockpiles that do little to educate students.”

Districts can apply for exemptions for three reasons: construction spending, pension liability and special education. According to state law, the districts then have to spend the money raised above the cap on those specific expenses. NBC10 was provided each district’s approved waiver applications by the Department of Education.

In addition to the exemption applications, a school district can also seek tax increases above their cap by putting a referendum before voters. The Commonwealth Foundation said it is not a popular route.

“Since Act 1’s passage, however, virtually no districts have sought voter approval,” the group said in a statement with its report, adding that legislation called SB 909, introduced by Sen. Donald White, would require voter permission for any tax increase.

The bill would require a referendum on all local proposed tax increases, regardless of the amount.

"I believe taxpayers must be empowered by having the final decision on real estate tax increases through a referendum process that cannot be bypassed by allowing for inflationary increases or automatic exemptions for certain costs,” White said in introducing the bill last year.

It has remained in the Senate Appropriations Committee since last October.